Introduction

2023 was full of surprises, and like most recent years, as investors, we expect 2024 to be no different. As we continue to mold our portfolios in preparation for the year ahead, we will recap the prior year and point to what we’re watching during this next trip around the sun. In this issue, we will discuss:

- Our review of 2023 – Confirmations and Surprises

- The Phenomenon of the Magnificent 7

- The Federal Reserve and its Ongoing Inflation Fight

- The Economy – Recession, Slowdown, Soft Landing, or No Landing?

- Crypto Market Developments in the Year Ahead

- What to Watch in 2024

We hope you enjoy this 2024 Outlook from Beck Capital Management.

2023 in Review

Following a dismal investing year in 2022, 2023 provided quite a sigh of relief for investors, at least for those participating in the equity market. 2023 left many investors on the sidelines, opting to stay in high-yielding cash positions that continued to return more as the Federal Reserve lifted interest rates. To cash investors’ dismay, however, while they may have returned roughly 5% in cash over the year, fortune favored those who stayed invested: as of December 29th, the S&P 500 Index finished the year up 24.2%, the Nasdaq up 43.4%, and the Russell 2000 up 15.1%. Cash may not be “trash” any longer, but it certainly didn’t keep up with equity returns. Bonds fared relatively poorly once again in 2023, but returns were positive, with the Bloomberg Aggregate Bond Index up 5.2% for the year.

Takeaways from 2023 – What Surprised Us and What Didn’t

2023 came with plenty of surprises from financial markets, along with several developments that met our forecast from our 2023 Outlook. Here are a few macro points that were confirmed and a few that surprised us:

Confirmations

- Inflation Continued to Cool Rather than Plateau – As we’ve been noting since late 2022, we’ve held a strong belief that inflation would continue to cool in the economy. We’ll discuss this more in-depth later, but the disinflation wave has not stopped, leaving the Fed rather pleased.

- Corporate Resiliency – Corporations remained resilient throughout 2023. While hiring did slow, and some layoffs occurred, corporations became more cost-conscious and resilient through this cycle, leading to insulated earnings and protected margins.

- Consumer Strength – The consumer remained strong as we expected. Inflated household balance sheets from Covid-era stimulus wound down throughout the year but kept consumer spending high even in the midst of inflation. Wage growth now exceeds inflation, and we expect the consumer to stay relatively strong going into 2024.

Surprises

- Market Performance – We remained invested in the market in 2023 and expected positive returns, but we were pleasantly surprised by just how well equities performed. We believed returns would fall within high single to low double digits, and they far exceeded expectations. Corporations were able to preserve earnings, and strong consumer spending propelled the market forward more than most strategists had expected.

- China’s Reopening Fell Flat – We expected China’s reemergence from its draconian lockdown policy to bring with it a strong international economic boost. We remained out of Chinese equities in 2023 but were surprised by the minimal stimulus efforts the Chinese government put forward to spur its economy. We don’t expect much out of China this year either, as political tensions with the West remain high, limiting their economic growth.

- Volatility Fell Throughout the Year – We expected volatility to drop from relative highs in 2022, but market volatility decreased significantly into year-end as markets continued to climb. We anticipate continued low market volatility into 2024 as the Federal Reserve begins its rate-cutting campaign.

The Phenomenon of the Magnificent 7 Stocks

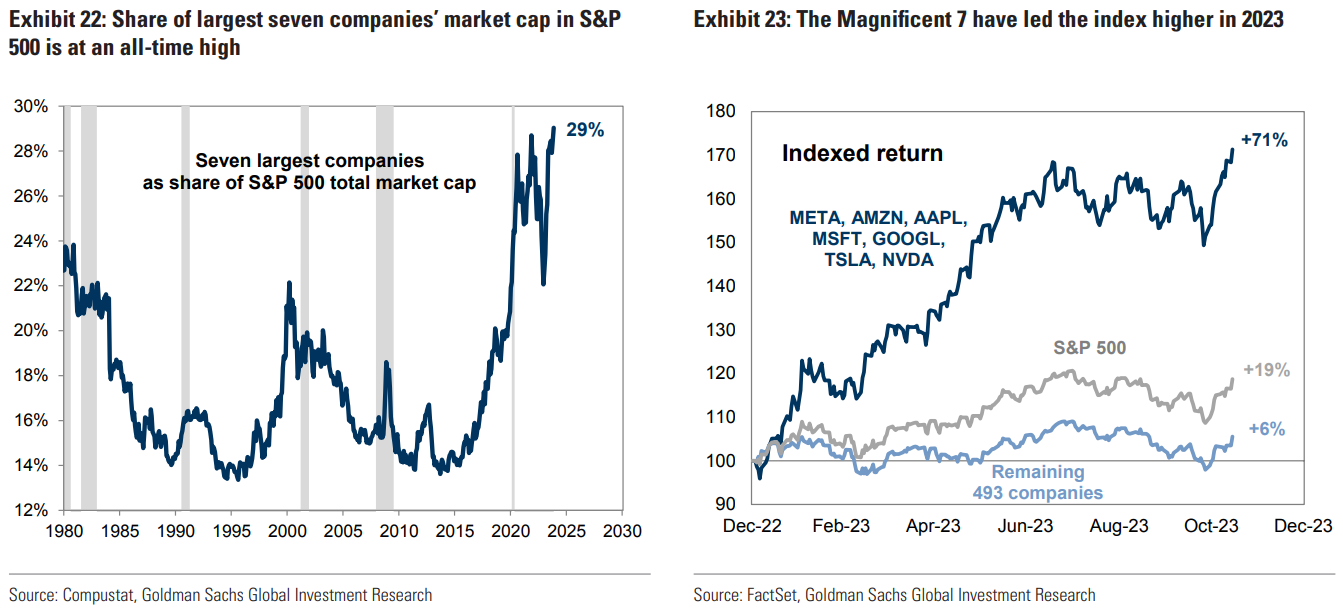

2023’s market advance was owed primarily to a handful of Mega Cap stocks that investors appropriately deemed “The Magnificent 7.” These companies (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla) made up roughly 55% of the S&P 500’s return this past year. Without these seven stocks, the S&P 500 would have returned just over 12% compared to its 24.2% return. Why were equity returns so limited to these companies, you may ask? Investors flocked to companies they deemed “safe” in 2023 following the market rout of 2022, meaning they flew into the largest blue-chip companies in the market. Combined with depressed valuations coming out of 2022 and an A.I. craze that propelled the broader tech sector, these companies were huge beneficiaries.

Will they stay Magnificent in 2024?

We believe some of the Magnificent 7 will demonstrate strong returns in 2024, but don’t expect 2024 to be a year dominated by these Mega-Cap companies. In recent weeks, we have already seen market breadth improve, meaning small-cap and mid-cap companies (SMid Caps) are outperforming. We believe that SMid cap companies have room to run in 2024, and we are broadening exposure to these areas. As investors anticipate imminent rate cuts by the Fed in 2024, they will be more inclined to invest in these somewhat “riskier” categories. Depressed valuations in the SMid Cap space are likely to return to historical norms, and 2024 could very well see a resurgence of the broad market. We do remain selective in the small and mid-cap space, however, as the Russell 2000 (the 2000 company small- and mid-cap index) now consists of 40% unprofitable companies. As always, we prefer exposure to profitable companies with growing earnings, increasing cash flow, and positive macroeconomic dynamics. We believe the equal-weighted S&P 500 and equal-weighted Nasdaq will outperform their respective market-cap-weighted indices this year.

The Fed and Inflation:

The Fed has officially* completed the fastest rate-hiking cycle in over 40 years, with the Fed Officials’ rate expectations (as shown in the “Dot Plot”) showing lower rates to come this year, with three rate cuts represented by the median “dot” or forecast.

There remain many questions surrounding what comes next as the Fed guides the economy into what it hopes will be a soft landing.

* Not a guarantee, but all indications point to the end of rate hikes

Rate cuts are forecast for 2024, but why?

Many economic factors are driving the Fed toward cutting interest rates, and while opinions differ around the correct magnitude and duration of the rate-cutting cycle, most agree that there is only one direction for rates to go from here – down.

- Inflation is down – As of November-end reports, core CPI inflation (inflation excluding food and energy) has been running at 4% over the past year, with headline (total) inflation driven down to 3.1% by lower energy prices. PCE, the Fed’s preferred inflation measure, showed core inflation of only 3.2% over the past year and headline all the way down at 2.6%.

- Goods prices are deflating – Goods have been in deflationary territory for the past five months, meaning goods are actually getting cheaper. Deflation should be distinguished from disinflation, where prices are increasing, albeit at a slower pace.

- Super core inflation – Super core inflation (core inflation excluding shelter) is down to only 2.1% over the past 12 months, just over the Fed’s stated target of 2%. This is possibly the most important metric to keep in mind as we explore the effects underlying shelter inflation next.

Shelter Inflation

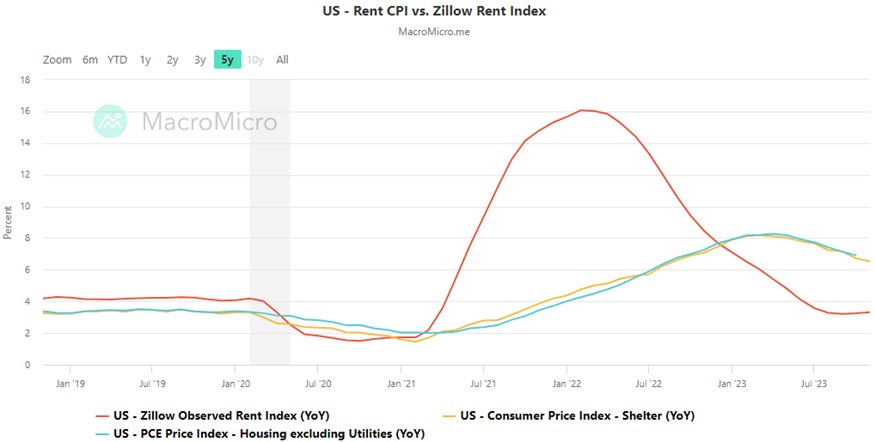

Shelter inflation is the largest contributor to headline and core inflation, so we are closely watching its trend and implications for broader inflation data. Shelter inflation is still elevated at 6.5%, but we’d argue that this is primarily due to how CPI is measured versus what actual housing market prices look like. CPI calculates rents and Owners’ Equivalent Rents (as discussed in further detail in our previous quarterly newsletter) as the average price over the past 12 months, effectively adding a 12-month lag on top of the 12-month window over which inflation is measured.

This contrast is best visualized via comparison to non-government metrics, such as Zillow’s Observed Rent Index, which follows active rental prices in the market:

We can see that while shelter inflation, as measured by CPI, didn’t peak until early last year (yellow and blue lines), actual rental inflation peaked a full year prior (red line). As these prices continue to be reflected in the CPI measurement, shelter inflation should continue to drop.

How many rate cuts should we expect?

- The Federal Reserve laid out its proposed “flight path” (to continue the “soft landing” analogy) in the December release of its quarterly Summary of Economic Projections (aka. The Dot Plot), with the target Fed Funds rate ending 2024 between 4.5% and 4.75%.

- The markets are currently expecting a year-end 2024 rate below 4% (implied via pricing in Fed Funds Futures markets). This number fluctuates from day to day but has remained mainly in the 3.7% to 3.9% range over the past couple of weeks.

- At Beck Capital Management, our expectation is somewhere in the middle – we are expecting 4 or 5 rate cuts this year, bringing the target interest rate to somewhere between 4% and 4.5%.

- We base this expectation on many inputs, including:

- The Fed’s dot plot came in more dovish than many expected, but they’ve continued to temper market expectations in an effort to keep monetary policy tight and avoid over-easing financial conditions. This leads us to believe that the “risks” are more heavily weighted toward lower rates.

- As inflation continues to drop, high interest rates become increasingly restrictive for markets, resulting in what’s known as “passive tightening.” This increased passive tightening will prompt the Fed to cut. Based on our above inflation expectations, this will also push the Fed to cut more quickly than they have indicated.

- The markets have been running hot since the latest FOMC meeting, with many using the Fed Funds Futures market to speculate, in addition to normal hedging activity, pushing those implied rate expectations lower than what we believe is likely to materialize.

A recession, slowdown, or a perfectly soft landing for the economy?

As we enter what is hopefully the final stage in this interest rate cycle, the natural question is, what happens next? For the past two years, many market commentators have expected to see a recession “in six to nine months;” however, one has yet to materialize.

While there have been many hurdles, corporations have been surprisingly resilient in navigating the first elevated interest rate environment in a decade. While many risks still remain, the underlying economy is doing well, with relatively few cracks starting to show.

We expect a GDP slowdown early in the year, with corporations cutting costs to protect earnings, but the recession risks are mostly behind us.

- Inflation is easing faster than many anticipated, with our forecasts leading us to believe that the “last mile of inflation” won’t be as “sticky” as many have suggested.

- The Fed’s real GDP (GDP after adjusting for inflation) expectations have consolidated around the 1.2% – 1.4% range, based on their inflation expectations – if inflation declines in line with our expectations, that will serve as a tailwind and push the economy closer to 2% real growth.

- According to Goldman Sachs, about $790B in corporate debt matures in 2024, most of which will need to be refinanced at higher rates. However, with interest rate expectations lower than many expected just a few months ago and the incredible growth of private lending over the past few years, companies have additional latitude to refinance these facilities at manageable rates.

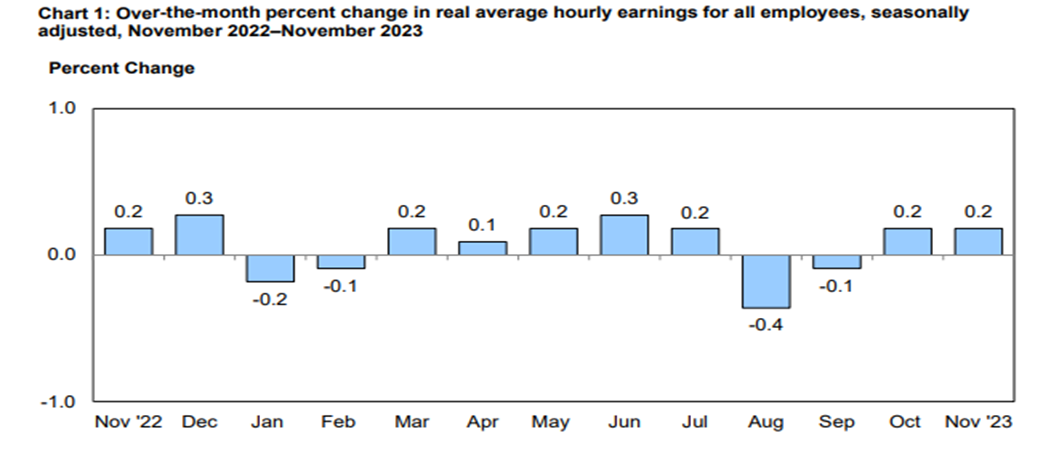

- Wages are once again growing faster than inflation, leading to a more robust consumer and lower chance of a pullback in spending.

Source: US Department of Labor, Bureau of Labor Statistics

What to Watch in 2024

Beyond the macro-driven landscape of this year’s market, guided primarily by inflation data and the Fed’s interest rate decisions, there are several important trends and events we are watching. Among the most important are artificial intelligence development, global geopolitical tensions, and the implications of the 2024 election.

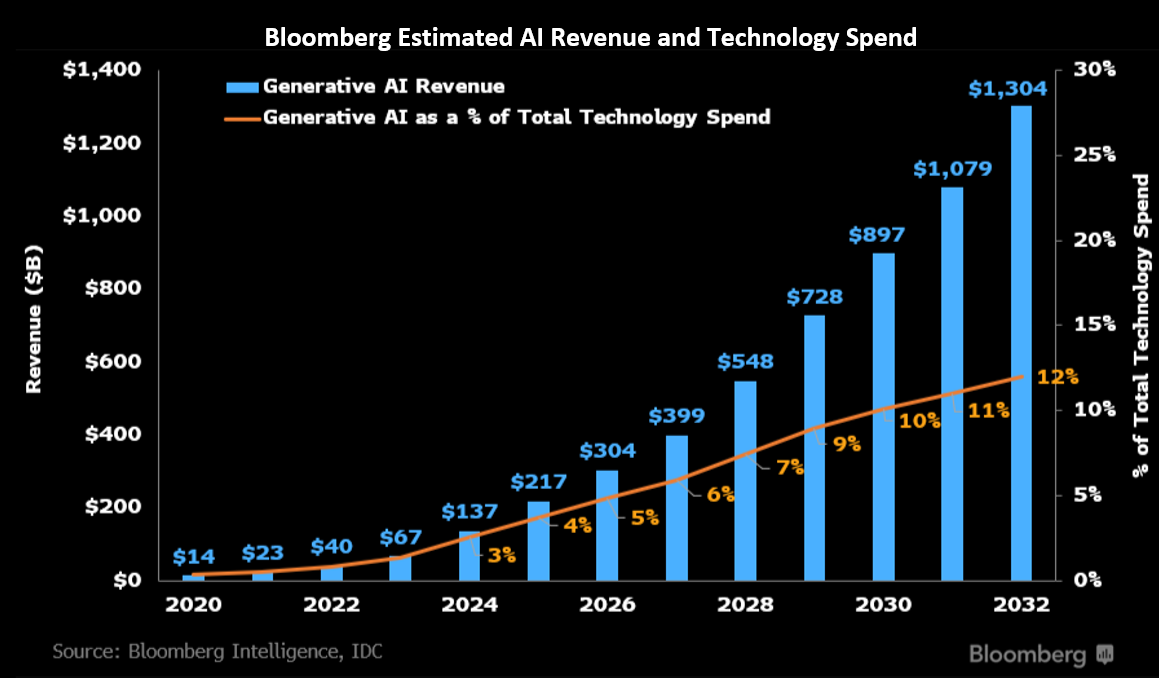

Artificial Intelligence – We have spoken before about the importance A.I. will have on the market, economy, and life as we know it. Many of the use cases for A.I. have yet to emerge, and 2024 will be an enormous year for generative A.I. applications. The bigger question in our minds is how do we invest to profit from it? Currently, there is an arms race for computing power – companies are building new data centers with the latest chips and infrastructure needed to power these computing-intensive applications. The first winners in the A.I. race will be digital infrastructure companies: those building the chips, power systems, server racks, and ancillary hardware. These companies will witness huge demand for their products, while A.I. software developers will still be writing the checks. Hardware is where we are first focusing our investments until A.I. software developers start cashing more checks than they write. Once enough data center infrastructure is in place, we anticipate pivoting to the application providers who will benefit from the inherent economies of scale that come with software issuance. 2024 will be a tale of the hardware providers, whereas late 2024 and 2025 will likely be a story about the applications developed by those now putting hardware in place.

Global Geopolitical Tensions – Tensions across the globe remain high as governments grapple with the ongoing war in Ukraine, the recent unrest in the Middle East and Israel, and ongoing hostilities between China and Taiwan. 2024 will likely see these conflicts further swell. As Eastern supply chains turn increasingly precarious, U.S. corporations are focusing on supply chain nearshoring (moving closer to home) and “friend”-shoring (moving closer to friendly countries). The largest beneficiaries of this move will be India, Mexico, and other Latin American (LatAm) countries. U.S. corporations are already spending billions in capital expenditures to relocate their supply chains to these countries, and their economies have only just begun benefitting. We maintain the bulk of our ex-U.S. investment in India, Mexico, and broader LatAm, as we witness their middle classes become more affluent and their economies grow via greater wealth and consumption.

The 2024 Election – We would be remiss not to acknowledge the upcoming election this year. While presidential elections generally have minimal impact on the broader economy, presidential election years in which an incumbent president is running have witnessed the S&P 500 advance by double digits every instance since WWII. This is only a single data point, but beyond the stats, we believe the incumbent administration will push for policy that benefits the economy and markets in an effort to shore up votes heading into November. A tailwind of fiscal stimulus would be another benefit to markets and could further contribute to what we believe will be a positive year for investing.

Crypto Markets and Upcoming Spot Bitcoin ETFs

A renewed focus has fallen on the crypto markets recently, with an uptick in volume and price appreciation that the market hasn’t seen for the past three years. This focus, however, isn’t only being driven by crypto-natives or gambling addicts grappling with the end of College Football season, but by retail and institutional investors, who are all gearing up for the launch of Bitcoin Spot ETFs.

Why are spot ETFs important?

While there are many crypto ETFs out there, they’re currently all based on crypto futures, leading to large discounts to Net Asset Value (NAV) across many of the most popular ETFs. GBTC, a popular bitcoin ETF, was trading with a 46% discount to NAV at the beginning of 2023! Spot ETFs will allow for lower costs and near-perfect performance tracking of the underlying asset.

Who & When?

- Spot ETFs are currently awaiting SEC approval, with a January 10th deadline. Expected approval is January 8th – 10th

- Thirteen companies have submitted applications to the SEC for a spot Bitcoin ETF, including many of the most prominent ETF players, such as BlackRock, Invesco, WisdomTree, and Fidelity.

- Applications are expected to receive “batch approval,” meaning that all applicants hear from the SEC simultaneously, regardless of when the application was submitted.

- This prevents “first mover advantage” and allows for better competition between companies.

- Ethereum Futures ETFs received this style of approval from the SEC in October 2023, and the format seemed well received by market participants and the SEC.

Will Other Crypto Currencies get the same treatment?

For the most part – probably not. Currently, only Bitcoin and Ethereum have SEC-approved futures ETFs. Bitcoin is expected to get spot ETF approval this month, with Ethereum receiving the same later in the year, although exactly when is anyone’s guess. These two cryptocurrencies comprise roughly 65% of the total Crypto market cap (and even more if you exclude US Dollar-linked stablecoins), with no close 3rd place. SEC chair Gary Gensler has shown persistent wariness of the crypto industry, so even getting one spot ETF under his tenure is a big step for the industry.

Takeaways

Spot Bitcoin ETFs have already spurred the asset class and will likely continue to do so as investors gain access to a new alternative asset right through their brokerage accounts. Whether investors think Bitcoin has real, intrinsic value or is just a fad, they will likely soon have a tool to put their beliefs to the test.

Conclusion

2024 is likely to be another macro-driven year as investors watch inflation, the Federal Reserve, and interest rate decisions. However, there is plenty to be excited about as we continue into an investment-friendly environment. Over the next 12 months, lower interest rates, lower inflation, and exciting developments like A.I. should provide an investment landscape with plenty of options for us. We expect a less volatile year where equity, bond, and alternative investments are likely to provide respectable returns. Cheers to a new year and great days to come! Have a wonderful 2024.

Risks & Disclosures

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value.

The Nasdaq Composite Index is a market-capitalization weighted index of the more than 3,000 common equities listed on the Nasdaq stock exchange. The types of securities in the index include American depositary receipts, common stocks, real estate investment trusts (REITs) and tracking stocks. The index includes all Nasdaq listed stocks that are not derivatives, preferred shares, funds, exchange-traded funds (ETFs) or debentures.

The Russell 2000 Index is an unmanaged index that measures the performance of the small-cap segment of the U.S. equity universe.

You cannot invest directly into an index.

Small capitalization securities involve greater issuer risk than larger capitalization securities, and the markets for such securities may be more volatile and less liquid. Specifically, small capitalization companies may be subject to more volatile market movements than securities of larger, more established companies, both because the securities typically are graded in lower volume and because the issuers typically are more subject to changes in earnings and prospects.

Cryptocurrency is a digital representation of value that functions as a medium of exchange, a unit of account, or a store of value, but it does not have legal tender status. Cryptocurrencies are sometimes exchanged for U.S. dollars or other currencies around the world, but they are not generally backed or supported by any government or central bank. Their value is completely

derived by market forces of supply and demand, and they are more volatile than traditional currencies. Cryptocurrencies are not covered by either FDIC or SIPC insurance. Legislative and regulatory changes or actions at the state, federal, or international level may adversely affect the use, transfer, exchange, and value of cryptocurrency.

Purchasing cryptocurrencies comes with a number of risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks. In addition, cryptocurrency markets and exchanges are not regulated with the same controls or customer protections available in equity, option, futures, or foreign exchange investing.

Exchange-traded funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from the Fund Company or your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.