Q3 2023 Market View – Fed at the Finish Line

Introduction

In this newsletter, we will address the advance in markets year to date, the inevitable end to the Fed’s rapid rate hiking campaign, equity market macro themes we are watching and believe will outperform in the second half of the year, and the AI revolution we believe is likely to drive productivity and market multiples in the years ahead.

A Mega(Cap) Start to the Year

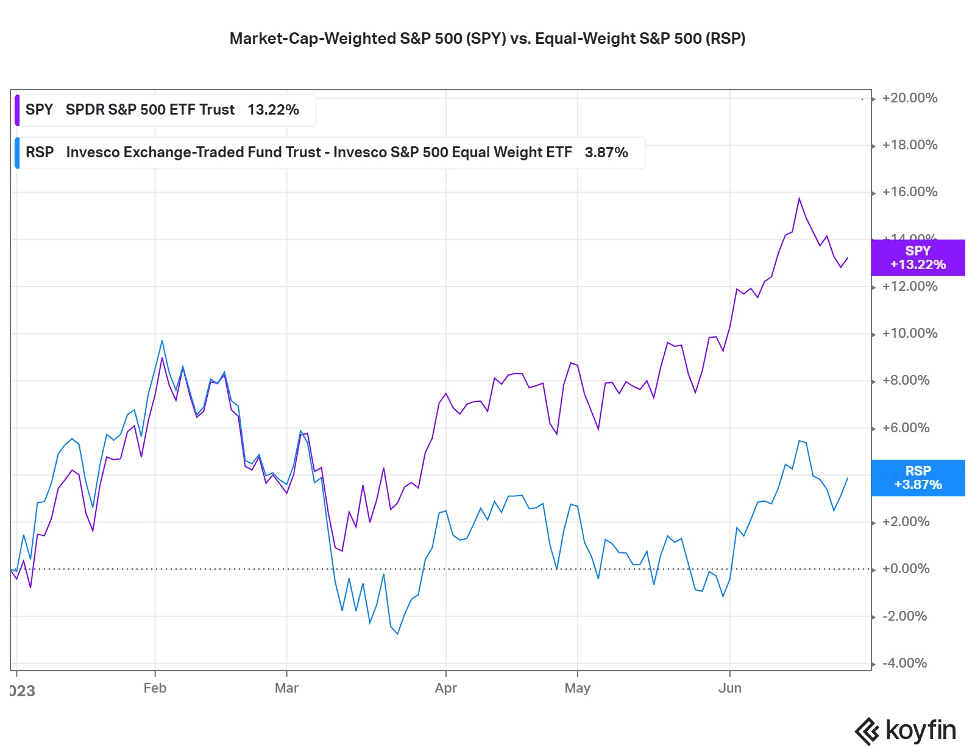

As of June 27th, the S&P 500 has advanced 13.3% year-to-date (YTD). One might be inclined to believe this means the broad market has performed fairly well; however, the advance has been driven almost entirely by the seven largest companies in the index. 11.2% of the advance (84% of the gains) has been AAPL, MSFT, NVDA, AMZN, META, TSLA, and GOOG/GOOGL. In fact, 42% of S&P 500 companies are actually negative on the year. This dichotomy between large tech companies and the rest of the market diverged during the banking crisis of mid-March. As can be seen below in the comparison between RSP, the equal-weight S&P 500 ETF, and SPY, the market-cap-weighted ETF, divergence occurs in mid-March and RSP has only recently begun to catch up.

The divergence can be mainly attributed to a flight to “safety” in mega-cap names. Investors saw the world’s largest companies as a safe place to park their dollars while maintaining their equity exposure. Now that markets have stabilized and the Fed is concluding its rate hiking campaign, the flight-to-safety benefit has diminished, and we believe the rest of the index should begin to close the gap.

Will SMid-caps get their revenge?

While the largest names in the S&P 500 have been the stars of the show year-to-date, we believe many Mid Cap and some Small Cap companies (SMid Caps) will see a resurgence in the back half of the year. Valuations for these companies remain low compared to the Mega Cap names while earnings have come in attractively so far this year – leaving room for significant price appreciation. There are areas in the SMid space we prefer to stay out of – banks and commercial office space in particular, but we believe there are many companies in Energy, Industrials, Materials, and other sectors of the market that remain very attractive.

Does the S&P 500 Market-Cap-Weighted Index Actually Offer Diversification?

The top 5 companies in the S&P 500 now make up roughly 24% of the index, which begs the question: does the index truly offer diversification? With so much concentrated company-specific risk, the index offers the lowest diversification since the dot-com bubble. At the sector level, diversification is even worse. Energy, Materials, Industrials, and Real Estate – four of our preferred sectors – only constitute a combined 17.3% of the index. Compare this to Information Technology’s 28.1% share and it’s easy to see how sector weights have become lopsided over recent years. Twenty years ago, these weights were roughly 22% and 14.3%, respectively. Then, the index offered more proper diversification among companies and sectors.

As active and diversified investors, we believe differentiating from the broader index is becoming more and more important. There are valuable companies in all sectors of the market, but traditional index investing is no longer proving to be a proper diversifier.

Is the Fed Finished?

At the June Federal Open Market Committee meeting, the Fed decided against raising rates for the first time in 15 months. After 500 basis points of hikes, we believe the Fed is at (or very near) the end of its rate hiking cycle. All of 2022 and YTD in 2023, the macro narrative has been extremely Fed driven. Market swings have occurred in both directions given the relative dovish or hawkish sentiment that has come across the tape. It is at this point, we believe the pendulum swings to a more dovish (and positive) sentiment as the Fed concludes its rate hike journey. We are within 0-50bps of remaining rate hikes which bodes well for assets across the spectrum – from equities to fixed income and REITs.

Why is the Fed Done Hiking?

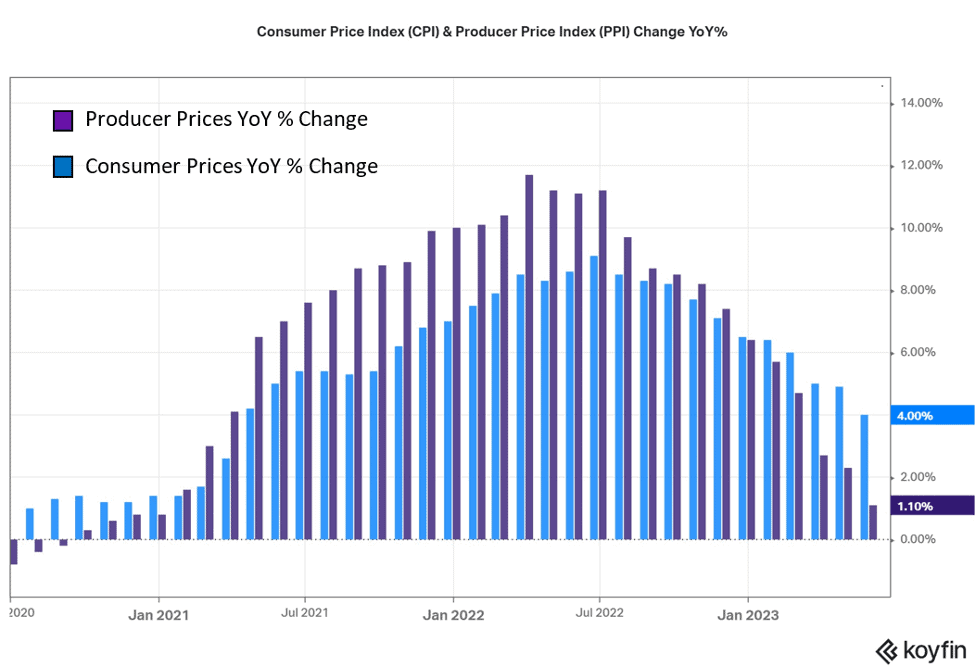

In a word, Disinflation. Meaning, a decrease in the rate of inflation. Disinflation is prevalent in the market: from wall street to main street, prices are rising at more modest rates than they have in months. In 2022, the market peaked at a Consumer Price Index (CPI) inflation rate above 9.1% YoY and we have steadily declined to what is now only a 4% YoY rate. We have reason to believe inflation rates will further decline because Producer Price Inflation (PPI), a measure of prices paid to U.S. goods and services producers, has declined even more drastically than CPI. PPI is typically a leading indicator for CPI as producers’ input prices eventually dictate what we all pay as consumers.

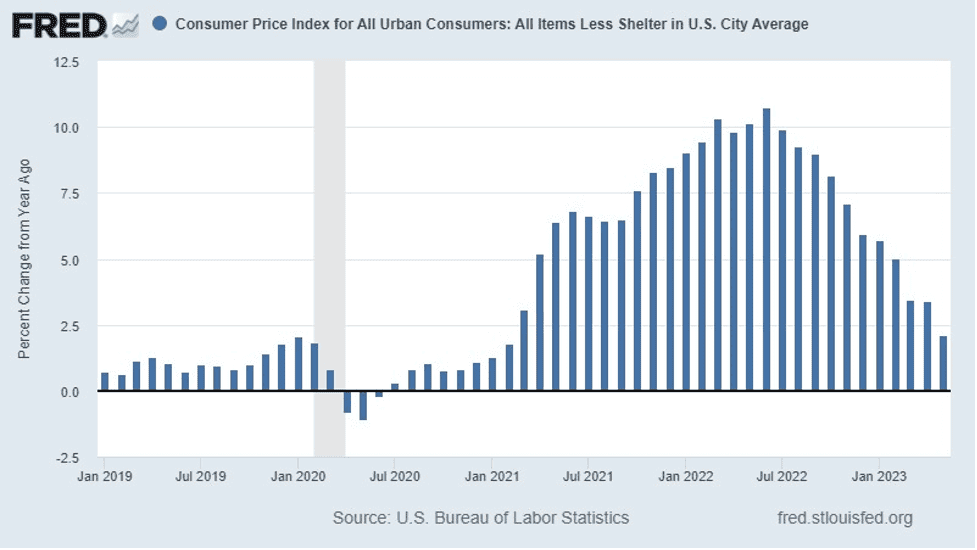

Headline CPI has fallen dramatically over the last year, but the change is even more pronounced when Shelter prices are excluded. By observing current market prices – rents and home listing prices – it is clear to see that prices have declined from their peaks in early 2022. The housing market has cooled with the lifting of mortgage rates and higher apartment availability has led to rent competition. Traditional Shelter inflation in the CPI report is skewed, because rather than using the most recent prices and rents, the data observes a 12-month average, effectively creating a 12-month lag in the data. Accordingly, inflation ex-Shelter has almost reached the Fed’s target range of 2%. We anticipate Shelter prices to drive the CPI lower in the months ahead, rather than serve as a headwind to disinflation as it has thus far.

Why Does Disinflation Matter?

The Fed has a dual mandate: to foster economic conditions that achieve both stable prices and maximum sustainable employment. Since the beginning of 2022, the Fed has almost exclusively focused on the price stability facet of its mandate, increasing interest rates to quell the tide of inflation. As inflation subsides, the Fed no longer must continue raising rates. Higher rates discount equity prices and hurt fixed-income valuations. Once we witness stable rate policy (or even declining rates), there is runway for equity prices to lift again and fixed income to maintain a stable valuation. Lower rates should make it easier for companies to borrow and relieve debt burdens, leading to greater economic activity and brighter earnings outlooks.

Income Generation

The rapid rate hikes of 2022 and 2023 have presented us with new and higher-yielding opportunities to generate cash income after years of near-zero interest rates. Bonds, REITs, and similar fixed-income-like assets got crushed as the Fed aggressively raised rates to pull their yields up above the Fed funds curve. Now that the pain has stopped, we can start to take advantage of once-in-a-decade rates.

Real Estate Investment Trusts

As the Federal Reserve closes out the fastest rate-hiking cycle in over 40 years, REITs are once again well-situated to provide current income and capital returns after being sold off during the interest rate run-up. Agency MBS and property REITs have repriced, presenting similar, yet differentiated, opportunities. Both generate cash while positioning the portfolio to take advantage of the stabilization and subsequent lowering of interest rates – just like bonds, as the reference rate drops, the security’s price increases to bring yields back to equilibrium.

Mortgage REITs, especially Agency MBS, are very attractive in the current market environment, as they’ve repriced to yield high single to low double-digits on government-backed mortgages. This stands in contrast to corporate debt, where it’s necessary to move out on the risk curve into B and CCC-rated corporate debt to achieve comparable yields while having limited potential for capital appreciation.

Property REITs have reacted similarly, but their price is anchored by the value of their underlying property, making them relatively less volatile and lower yielding. In the 4-5% range, they might not offer a high yield, but because their stock price is closely related to their NAV, they provide the asset appreciation and inflation hedge that real estate offers.

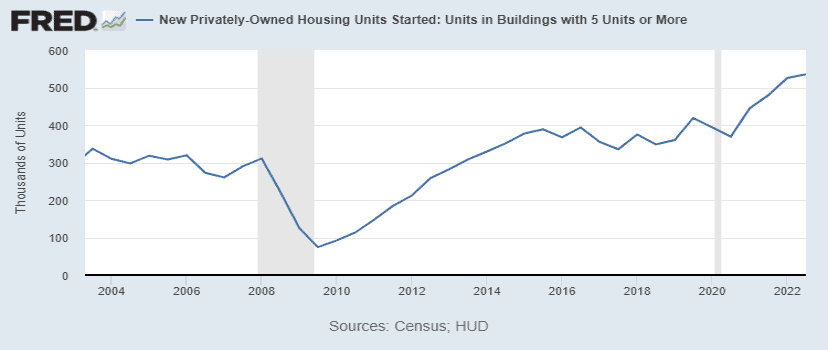

REITs can take many different forms, and in this market environment, it’s more important than ever to be selective about which areas of the market you’re investing in. We prefer to stay out of office real estate, for example, as it’s too far out of favor with the market and rare to present opportunity. Similarly, Multifamily REITs have been historically compelling, but given the considerable supply of multifamily coming online, it isn’t our preferred segment.

Multifamily starts are now running around 1.7x their pre-’08 levels.

Given current market conditions, we’re looking for extended lease terms on quality properties operating in non-cyclical sectors; this pushes us towards ideas such as medical properties like hospitals and industrial properties like data centers. Similarly, Grocery-anchored shopping centers have long lease terms on key properties and high occupancy rates on auxiliary stores, despite relatively higher turnover.

Private Credit

The opportunity presented by elevated rates doesn’t end with Real Estate; Private Credit is an increasingly popular way to take advantage of elevated rates and tightness in the banking system.

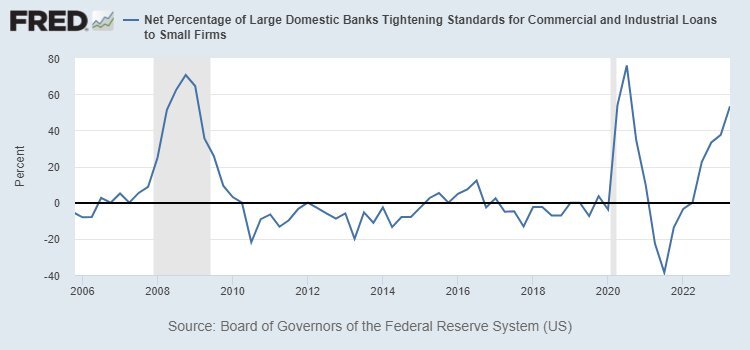

At a time when banks are defensively repositioning their balance sheets, many large, credit-worthy companies are finding themselves in need of capital from non-traditional sources as their existing loans come due.

Here we can see the credit tightening from large banks for Commercial and Industrial loans to small firms as a key example. The charts of other credit lending look similar. There isn’t a preferred sector or project type, just a blanket tightening of balance sheets.

COVID and the Global Financial Crisis are the only other times in recent history that compare to this level of credit tightening; however, this time, it’s occurring during a period of elevated interest rates, which private credit companies can take advantage of.

Just at the beginning of June, the CEO of PNC bank expressed a desire to lend but an inability to, saying, “We’re not going to add to office [loans]. There’s actually a lot of office deals I’d like to do, but the headline number of “Hey, your office exposure went up” isn’t worth it, which is kind of the unfortunate truth about banking, right?”. When banks aren’t willing to lend, it allows private groups to pick up quality loans at above-market rates; Private Credit has expanded beyond small or credit-risky companies in recent months and years, with blue chips like AT&T recently taking advantage of the liquidity to pay off and refinance their existing debt obligations.

The final place we’re seeing opportunities to generate cash is within the Energy sector. As we’ll cover in the next section, we’re bullish on Oil for a number of reasons, but one aspect that often goes overlooked is the large dividends that can be captured from many Exploration and Production (E&P) companies and others in the energy sector. With increased scrutiny from the current administration, oil companies have slowed reinvestment in drilling new wells, opting instead to distribute their cash flows to shareholders. Many companies, well positioned to participate in an oil boom, are delivering high single and low double-digit dividends, even with oil trading around $70 a barrel

Equity Themes

Our U.S. sector tilts haven’t changed materially year-to-date as we watch our investment thesis play out. We remain highly convicted in the Energy, Industrials, Materials, and Real Estate sectors, as well as areas of Technology, Healthcare, and Consumer Discretionary. We are still highly selective when it comes to the companies we purchase in the portfolio – favoring quality companies with positive earnings, cash flow generation, low debt, and strong economic outlooks. As the macroeconomic picture continues to develop, we are making tactical allocations among these sectors based on which companies we view to be the biggest beneficiaries.

Energy

Our energy investment thesis rests on supply and demand-side factors, both contributing to what we view as a bullish outlook for crude oil prices and the companies that sell it. On the supply side:

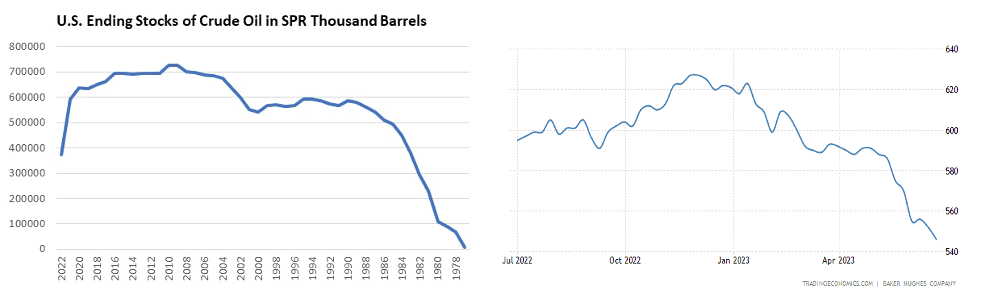

- U.S. Oil rig count is declining – Lower oil prices have led to decreased drilling activity. Companies are more interested in returning cash to shareholders than investing in new oil projects and the active rig count has shown that. Declining from a peak of 591 active oil rigs in April to just 546 active rigs as of June 23rd.

- U.S. SPR releases have concluded – After releasing 180 million barrels of oil from the Strategic Petroleum Reserve (SPR) last year along with 26 million barrels in 2023, the U.S. has concluded its drawdown of the SPR as of June 30th. We expect this will no longer serve as a headwind to prices, and although there are only 6 million barrels expected to be refilled to the SPR this year, oil flow is now moving in the right direction.

- OPEC+ production cuts and Russia’s infrastructure decline – We have mentioned these before, but the combination of OPEC+ production cuts and Russia’s inevitable degradation of its energy infrastructure will contribute to slower oil supply growth for the global market.

Several factors support our demand-side oil thesis:

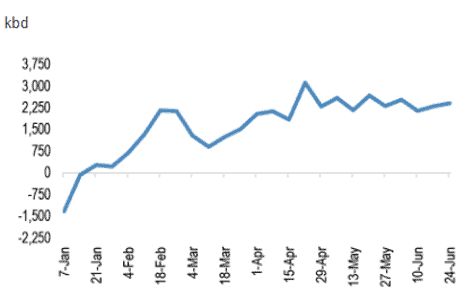

- Summer travel season is upon us – Traditionally, the Summer sees the highest seasonal period of demand for mobility fuels, and this year appears to be no different. U.S. gasoline demand is up to 9.3 million barrels per day (mbd), the highest level since December 2021. Combined with the post-Covid worldwide travel bug, we expect mobility demand to drive international oil demand.

- Emerging Market growth – India, Mexico, and other emerging economies are using more and more oil as their economies develop. This, combined with China’s reopening, should drive higher demand. China’s economic reopening has progressed slower than many expected; however, we expect their oil demand to progress in the second half of the year.

Global Demand for Mobility Fuels, YTD growth, cumulative

Industrials & Materials

Several macroeconomic trends are driving demand for industrial products and the raw material inputs required for their production and complementary applications.

- Housing Demand – Elevated mortgage rates have suppressed the supply of single-family homes, but there’s still demand left in the market despite mortgage rates remaining above 6% for the past nine months and peaking north of 7%. Existing homeowners are hesitant to give up their 2-4% mortgages, driving home buyers towards new-builds. Home Builders are benefitting from several tailwinds now that lumber prices (along with other inputs) have fallen almost in half, back into normal ranges from their COVID/Inflation highs. Unique to new-builds is the option to buy down mortgage rates – while it is an option for existing homeowners, it is often prohibitively expensive for individuals to do, meaning that homebuilders can offer mortgages in the 4’s while everyone else is looking at 6+% from their big bank.

- Federal Infrastructure Programs – Over the course of the past year, billions of dollars have been released to Federal, State, and Local governments to fund infrastructure projects, with hundreds of billions more earmarked for similar programs.

- The Cornyn-Padilla Amendment released approximately $40 billion of excess COVID relief funds for State and Local infrastructure projects.

- The CHIPS Act allocated more than $50 billion for Semiconductor R&D, of which a large portion will be spent on Fab development.

- The Inflation Reduction Act earmarked another $10 billion for infrastructure tax credits and $250 billion in Green Energy projects, which will drive additional demand for resources such as copper and lithium.

- Onshoring of Supply Chains – COVID-based supply chain disruption, international sanctions, tensions, and conflict, have led companies to re-shore their supply chains to limit exposure between markets. There are dozens of examples of companies bringing manufacturing back to the US, Canada, and Mexico, including Taiwan Semiconductor constructing a US Fab, Tesla building a lithium refining plant in Texas, and Tommy Hilfiger diversifying their manufacturing away from China and towards end-markets. Mentions of “reshoring” on earnings calls have more than doubled over the past year, and as factories move back to the area, Materials and Industrials companies will be here to supply them.

International Exposure

A new introduction to our portfolios this year has been increased international exposure, specifically to India and Mexico. These two emerging economies are experiencing impressive economic growth and are seeing increased rates of foreign investment.

India

India presents an attractive investment market for several factors:

- Population – This year India is expected to pass China to claim the title of the world’s largest population. Population growth alone helps drive economic growth, but India has a relatively well-educated population as well, serving as cheap yet intelligent labor for Western countries seeking to decouple from China.

- Supply Chain Realignment – Western manufacturers of high-tech products are increasingly relocating their manufacturing to India. While China has become an expensive and geopolitically precarious environment for critical supply chains, India has served as a haven for opportunistic manufacturing relocations.

- Political Affiliation – Prime Minister of India, Narendra Modi, has expressed intentions to become closer to the United States and the West. As the U.S. continues to bolster its relationship with India, the country’s economic success is increasingly secured.

Mexico

Mexico’s status as a critical trade partner of the United is nothing new, but we believe Mexico will increasingly benefit from its close ties with its Northern neighbor.

- Manufacturing Growth – the primary driver of Mexico’s success has and will be manufacturing. As more manufacturing is relocated out of China, Mexico benefits from new factories, high-paying jobs, and improved political and economic relationships with the United States.

- The Mexican economy is resilient – while much of the globe is experiencing an economic slowdown, Mexico’s economy has remained strong. Low unemployment, high retail sales, and robust GDP has led to peso appreciation and appreciation of Mexican equities year-to-date.

Artificial Intelligence Revolution

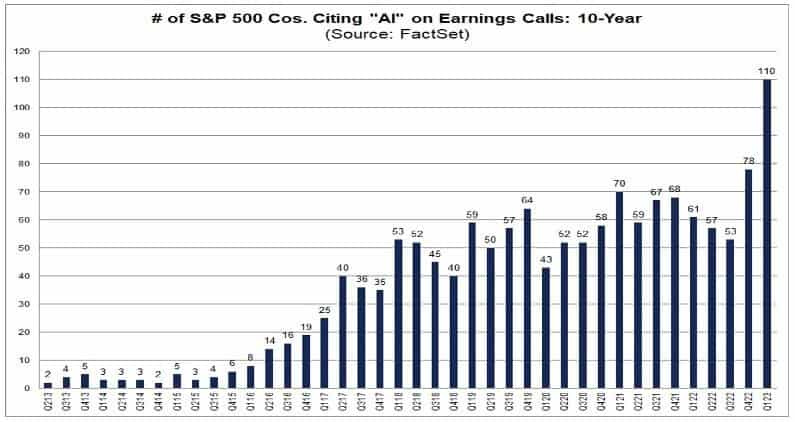

The AI hype train has left the station and has reached full speed over the past few weeks. Initially launched by a blowout Nvidia earnings call, it was further accelerated by a litany of AI-related announcements, both for real, game-changing applications of this exciting technology and for exaggerated use cases that are better classified as run-of-the-mill data science projects by overzealous execs looking to cash in on the excitement.

Not unlike the “Dot Com” craze of the late ’90s, we’re seeing incredible new advancements in technology that are being driven by a relative minority, with many companies participating “in name only”. We can see below that the mentions of “AI” in earnings calls have increased dramatically over the last earnings season as companies from all sectors feel obligated to comment on their actual or perceived Artificial Intelligence applications.

Over a fifth of the S&P mentioned AI on their first-quarter earnings calls, while only 64/500 are in the Technology sector

It’s relatively easy to filter out the noise, however, and we can focus on the many winners we expect to see in the space. Nvidia is already making significant revenue gains by selling the ‘picks and shovels’ everyone needs to implement AI and will be one of the most notable near-term beneficiaries as companies build out the necessary infrastructure to support this shift. Microsoft, Amazon, and Google have begun implementing AI to improve their products, including generative AI in Bing, better inventory management & logistics for Amazon, and Google’s new AI assistant, Bard. Perhaps the longest-running mainstream AI application comes from Tesla, which will benefit from both hardware and software improvements to hit CEO, Elon Musk’s goal of fully autonomous driving by the end of this year.

Adobe using AI to generate photos and simplify photo editing

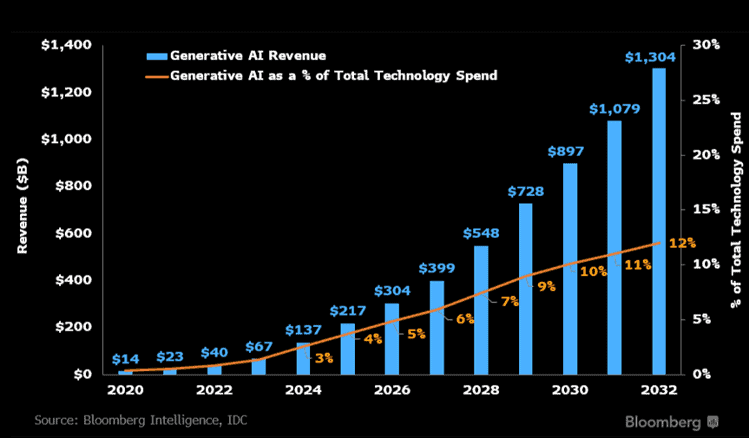

As shown below, Bloomberg expects the market for AI to balloon to $1.3 Trillion in the next ten years, and each of these companies is well situated to benefit from it.

Gains will extend beyond just the tech sector, however, as companies using AI will benefit from operational efficiencies and product improvements, from replacing call centers with generative AI bots and using it to identify bottlenecks in complex production lines, to using AI in the development of new drugs that would be impossible to design manually. Meta (Facebook), as an example, is already using AI to serve ads to users more tactically and drive additional clicks and revenue.

Conclusion

With the Fed at the end of its hiking cycle, we believe there are many compelling investment opportunities in the current market. While we think it remains critical to stay selective in the assets we invest in, from REITs and fixed-income-like securities to Tech Sector beneficiaries of the recent AI craze, we expect to find attractive prospects for our portfolios. This remains a precarious investing environment, but as the narrative becomes less Fed-driven, we are excited to return to a more fundamentals-based investing world where quality, cash-flowing companies are the ones reaping rewards. Here’s to an exciting (and hopefully fruitful) back half of 2023.

Disclosures

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor.

This document may contain forward-looking statements based on Beck Capital Management’s expectations and projections about the methods by which it expects to invest. Those statements are sometimes indicated by words such as “expects,” “believes,” “will” and similar expressions. In addition, any statements that refer to expectations, projections or characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Such statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Therefore, actual returns could differ materially and adversely from those expressed or implied in any forward-looking statements as a result of various factors.

Diversification does not guarantee a profit or protect against a loss in a declining market. It is a method used to help manage investment risk.

A REIT is a security that sells like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages. REITs receive special tax considerations and typically offer investors high yields, as well as a highly liquid method of investing in real estate. There are risks associated with these types of investments and include but are not limited to the following: Typically no secondary market exists for the security listed above. Potential difficulty discerning between routine interest payments and principal repayment. Redemption price of a REIT may be worth more or less than the original price paid. Value of the shares in the trust will fluctuate with the portfolio of underlying real estate. There is no guarantee you will receive any income. Involves risks such as refinancing in the real estate industry, interest rates, availability of mortgage funds, operating expenses, cost of insurance, lease terminations, potential economic and regulatory changes. This is neither an offer to sell nor a solicitation or an offer to buy the securities described herein. The offering is made only by the Prospectus.

Investing internationally carries additional risks such as differences in financial reporting, currency exchange risk, as well as economic and political risk unique to the specific country. This may result in greater share price volatility. Shares, when sold, may be worth more or less than their original cost.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value.

Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance quoted.

There is no guarantee that companies that can issue dividends will declare, continue to pay, or increase dividends.