Q2 2023 Market View – Opportunity in Crisis

2023 has started the way 2022 ended – volatile, macro-driven, and full of headlines driving sentiment all over the map. In this issue, we will discuss what we view to be some of the most important topics from the prior quarter, as well as some forecasts for markets moving forward. We will cover:

- The Silicon Valley Bank (SVB) collapse, banking fallout, and its implications for investing today

- REITs and Preferred shares – finding opportunities to pursue stable cash flows in uneasy markets

- The Federal Reserve’s actions and how they are likely to act moving forward

- Q4 2022 Earnings calls and what they said about the health of corporate America

- A review of the Energy sector and our updated outlook on oil & gas

- Opportunities surrounding Emerging Markets

- How we stomach volatility, seek to take advantage of it, and trust the investment process

Banking Fallout – What it Means for Markets

The recent Banking Sector turmoil sent fear back into the markets, captured international investor attention, and pressured the Fed to slow down rate hikes. Silicon Valley Bank (SVB) was the largest bank failure since 2008 and the second largest in US history, which spurred weeks of market turmoil and uncertainty about the broader economy. While SVB’s failure was caused by poor risk management, it cast doubt on the banking industry as a whole – especially other regional banks, both large and small.

Banks try to match the duration and liquidity of their assets to their liabilities, two of the primary sources of risk that banks face. To widen its slim margins, SVB decided to take on additional duration risk, and instead of investing in short-term, highly liquid securities, they bought longer-dated U.S. Treasuries to capture additional yield.

This risk-on behavior created issues for two reasons:

- The fast flow of communication between customers through social media created what many are referring to as a “Bank Sprint” that took only hours to unfold, as opposed to the traditional bank run which can take days or weeks to play out. In the age of digital banking, it takes seconds to send a wire on one’s phone.

- The Fed’s aggressive rate-hiking regime vastly devalued these long-duration bonds, forcing SVB into an undercapitalized position.

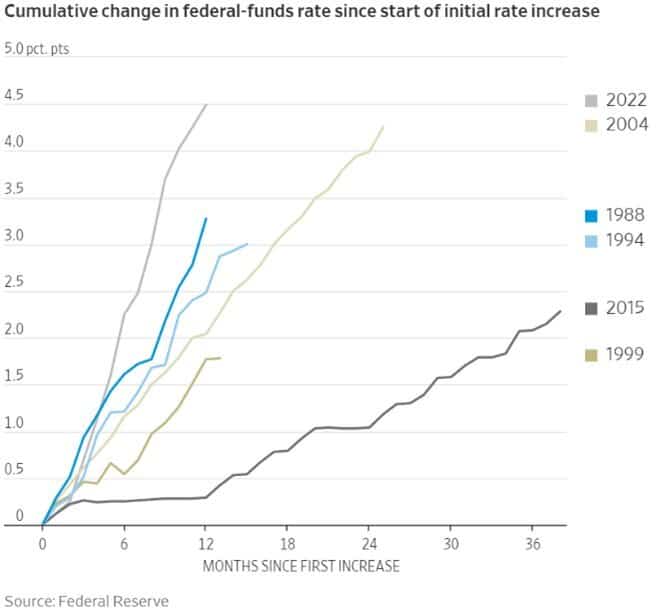

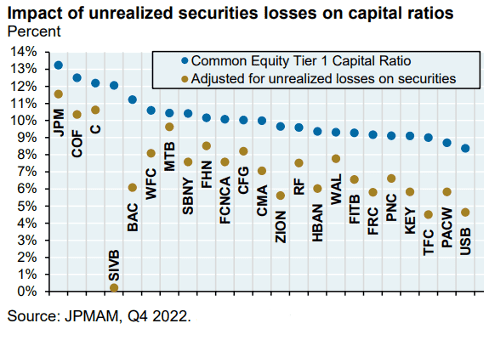

Over the past 13 months, the Fed has raised rates at the fastest pace in history. As the benchmark rate increases, bond yields rise along with it, pushing the price of these securities down. Banks everywhere hold US Treasury bonds as safe sources of yield on deposits, and the devaluation of bonds created abnormally large, unrealized losses.

of these securities down. Banks everywhere hold US Treasury bonds as safe sources of yield on deposits, and the devaluation of bonds created abnormally large, unrealized losses.

These losses don’t create substantial risk under stable conditions since banks can generally hold the securities to maturity and receive full par value. During periods of market stress, however, these securities can’t fully reimburse depositors as intended.

Shortly after SVB started facing liquidity pressures, the FDIC stepped in to take over the bank. The FDIC insures up to $250,000 per person, but SVB wasn’t a typical bank – most of their deposits were much larger, deposited by tech start-ups and VC firms. The US Treasury decided to take special measures to insure all deposits at the bank to prevent further banking fallout.

While all banks have experienced some unrealized losses, very few have put themselves in such a precarious position as SVB. Just days ago, a buyout deal was announced with First Citizens Bank to assume the majority of SVB’s assets and liabilities which should help restore confidence in regional banks. We view the banking sector as generally resilient but especially strong for big banks, with GSIBs (Global Systemically Important Banks), like J.P. Morgan and Bank of America, the chief beneficiaries of industry stress. As companies and individuals move deposits out of regional banks, funds are flowing into mega-cap banks. Although SVB isn’t alone in their capitalization issues (Signature Bank was the third largest bank failure, on March 12th. Credit Suisse finally fell, although they’ve been in poor financial condition for years). Banks in general are still adequately capitalized, and not, in our view, at risk of major contagion in the coming months.

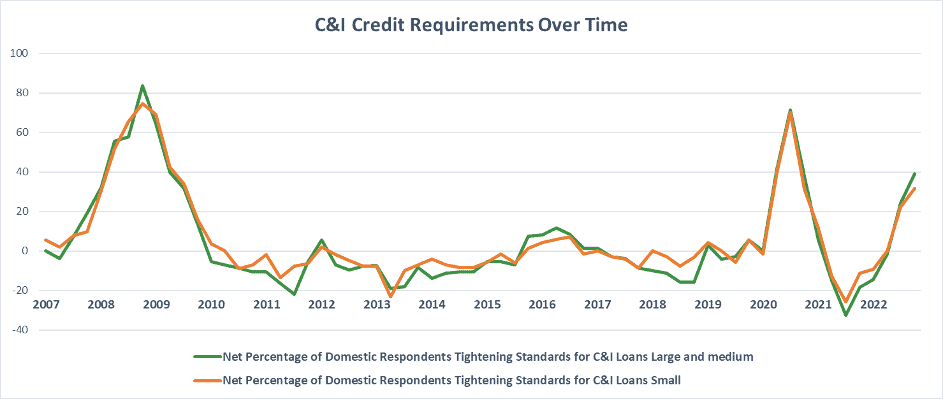

The Fed’s Senior Loan Officer Opinion Survey (SLOOS) shows that banks have been raising credit requirements for loans, over the past few quarters, at a pace we haven’t seen since COVID and the Global Financial Crisis (GFC) in 2008. Credit tightening effectively removes dollars from the economy and forces banks to de-risk their loan book. The graph below shows Commercial and Industrial loan requirements, but requirements for Commercial Real Estate and Consumer loans follow a similar trajectory.

The recent banking turmoil has created several risks and opportunities over the past month. Some key takeaways from Macro to Micro:

- Banking turmoil is a sign that the Fed has finally “broken something” and will force a slowdown in QT/Rate hikes.

- Credit tightening is inherently disinflationary, further aiding the argument for a lower rate ceiling.

- All bank stocks got caught up in the sell-off. This created a number of opportunities in the Mega-Cap space, for both common and preferred shares. Yields on high-quality preferreds like JPM-PD were pushed up past 6%.

Finding Opportunity in REITs and Preferreds

While the banking crisis was certainly a net negative for financial markets, it created opportunities in Real Estate Investment Trusts (REITs) and preferred shares, which we happily took advantage of. Fear of contagion drove valuations of industries tied to banks and financials downward, which meant huge repricing across the board. Even what we view as the most high-quality REITs and preferreds saw valuation declines the week of SVB’s collapse. This allowed us to pick up some historically strong, stable, cash-flowing securities at what we viewed as extremely attractive levels.

In the weeks since SVB’s collapse, these REITs have primarily traded upwards, leading to a near-term benefit to our portfolios. We are sticking to what we view as stable REIT investments – high-quality grocery-anchored shopping centers, necessity-driven retail, multifamily properties in high-demand cities, and industrial properties. Our office exposure is minimal, and we are keenly aware of REITs with high debt levels rolling over in the next two years. Similarly, in preferreds, we are sticking to quality financial institutions that have been largely unaffected by the banking crisis. We are invested in the preferreds of large institutions, which have seen deposit inflows since the banking chaos ensued.

Where Things Stand with the Fed

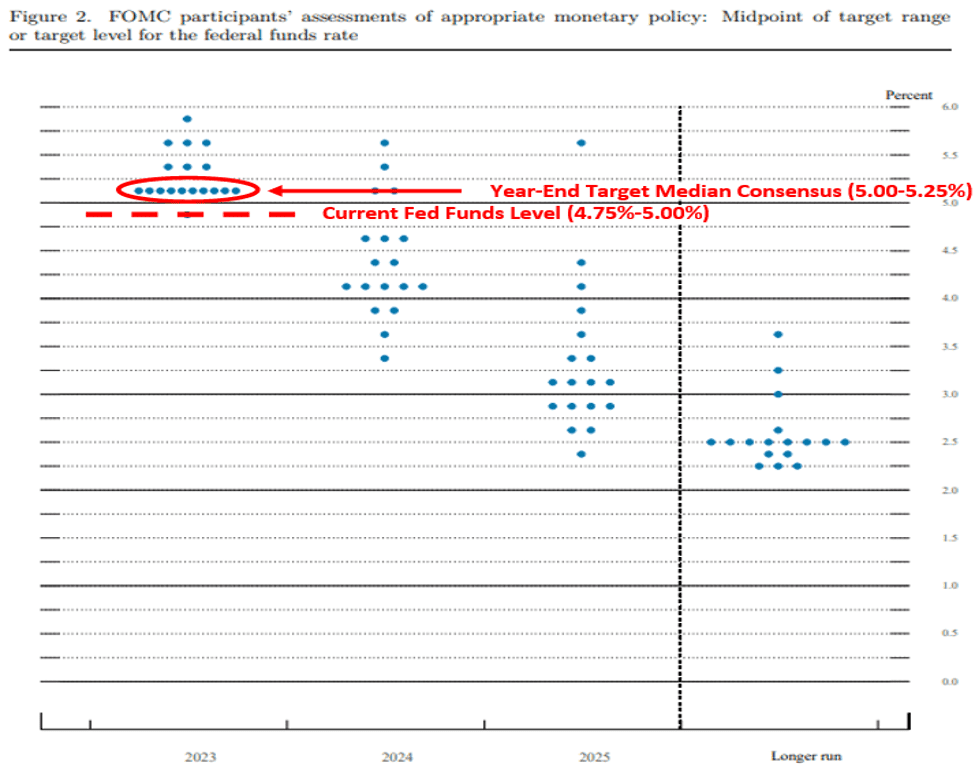

On March 22nd, the market received a long-awaited announcement from the Federal Reserve’s Open Market Committee formalizing another 25 basis-point or 0.25% rate hike to reach a Fed Funds target range of 4.75-5.00%. More importantly, the Fed released its new Summary of Economic Projections (otherwise known as the Dot Plot), forecasting its estimations for GDP, Fed Funds Rate, Unemployment, and Inflation. The Dot Plot is only released every other meeting, and given all that has transpired since January, the market was eager to understand the Fed’s take on financial markets and the role it has left to play.

Just a week prior to the SVB collapse and banking rout, Fed Chairman Jerome Powell hinted toward two additional 50bp hikes, but this forecast was dashed in the subsequent days as the Fed was faced with the reality of what their hikes had done to the financial system. Understanding the implication of its prior actions, the Fed was barely able to hike at this most recent meeting, and we believe it did so only to maintain confidence in the banking sector. Had they paused at this most recent meeting, it would have signaled too much damage to the baking system. In this case, the Fed got to have its cake and eat it too – a rate hike to continue fighting inflation while signaling strength and stability in the banking system. Looking at the Fed’s updated Dot Plot, they still believe there is one more hike left before they’re done in 2023; however, we don’t think another hike is necessary or even that likely to happen for several reasons:

- Financial conditions are already sufficiently restrictive – lending has tightened considerably, and the attractiveness of high-interest-rate loans is low for businesses. Lower dollar flow throughout the economy means lower business activity and lower inflation

- Banks are in a precarious position – additional rate hikes will only further compromise bank balance sheets. Even with stopgap measures from the Fed, FDIC, and treasury in place, banks are in a precarious position and the Fed must work around that reality. Analysts say the banking fallout creates an effective rate hike of around 100 basis points due to tightened lending alone

- Inflation is on the decline – Goods inflation is already at satisfactory levels for the Fed. Services inflation, driven primarily by shelter prices, is bound to retreat once new home and rent prices are reflected in the data. Shelter inflation lags the real economy by close to a year, so shelter inflation should be turning over in just a matter of time. We have witnessed home and rent prices declining in the marketplace

Regardless of whether there is one more hike or not, the peaking of interest rates gives us a more optimistic view of the market. As rates peak and begin to turn over, equities should be better supported. Quality growth companies, which were out of favor during the interest rate rise and provided buying opportunities then, will come back into favor as interest rates fall.

Q4 2022 Earnings

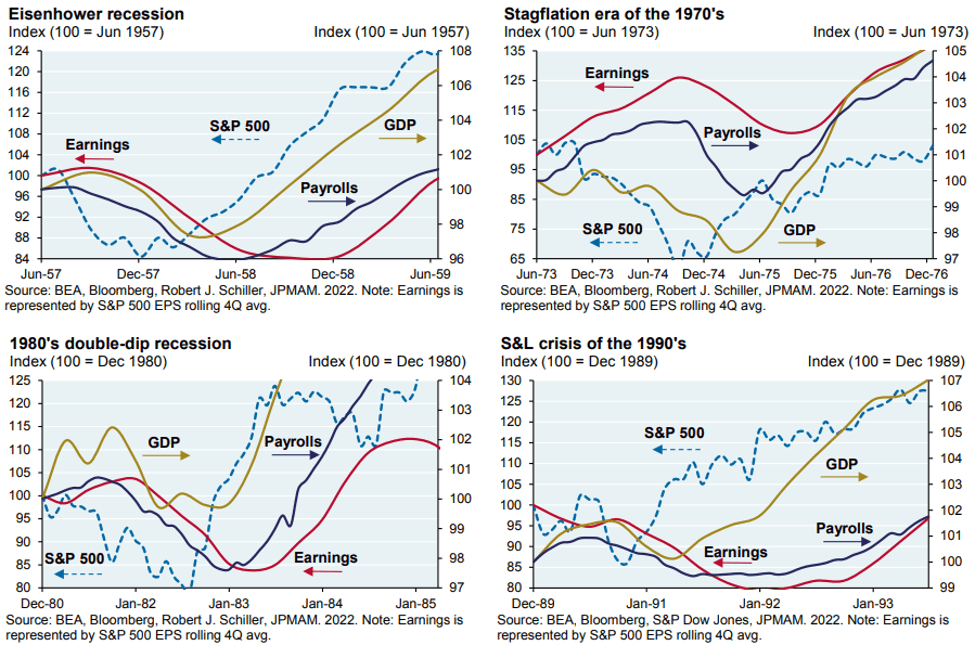

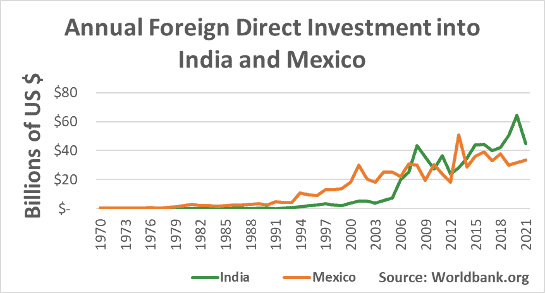

As was mostly expected, Q4 2022 earnings came in mixed for corporate America. 68% of reporting S&P 500 companies beat EPS estimates. This doesn’t sound too bad until one compares that to the 77% 5-year average for company earnings beats. The S&P 500 reported an aggregate decline in earnings of -4.9% which reflected the first decline since Q3 of 2020. Earnings expectations for S&P 500 companies have come down over recent weeks, but the earnings per share (EPS) estimate reductions have begun to slow. History tells us that the market will bottom before EPS revisions do, so we are keenly aware of EPS expectations moving forward. We believe the October lows for the market will hold, so a slowing of earnings revisions downwards is a positive in our view. This remains the reason why we are highly attentive to company profitability – we are choosing companies with growing growth prospects, while the market in aggregate is seeing earnings contraction. The charts below demonstrate the bottoming of the S&P 500 index prior to the bottoming of EPS expectations in prior recessionary periods.

Source: JP Morgan

The Irony of Q4 Earnings

While Q4 2022 earnings still left much to be desired, there were bright spots to note, but certainly plenty of ironies. Often, fiscal discipline was rewarded more than a positive growth outlook. Repeatedly, companies reporting strong earnings and increasing capital expenditure to fuel their growth were punished by the market while those that trimmed headcount and spending in the pursuit of profitability, even on the back of muted earnings, saw share price gains. Meta (META) served as a prime example, rallying over 20% on reports of job cuts even on the back of a -21% earnings miss. On the opposite side of that coin, Caterpillar (CAT) witnessed a share drop after better-than-expected sales growth, record operating margins, a growing backlog, and positive forward guidance. These ironies seem to be righting themselves in the weeks that have followed, but they provided attractive buying opportunities for many companies we liked at the time. We remain convicted in companies with earnings growth, positive free cash flow, and growing business prospects.

Energy Sector Outlook

As it remains our preferred sector in the market, it seems only appropriate we give an update on the status of oil, gas, and our current outlook. Energy prices have been volatile since the start of the year and will no doubt continue to be so, but we see plenty of opportunity in specific segments of the energy sector.

Oil Markets – Oil is currently our preferred segment of Energy markets as we see a combination of supply-side and demand-side dynamics that should drive the price of crude up over the course of the year. On the demand side, three factors drive our thesis:

- China’s Reopening – China was in deep lockdown from Covid-19 and has flipped the switch on its lockdown policy. Their economy is back up and running, and the government is willing to support economic growth. Economic growth = greater demand for oil.

- Emerging Market Demand – Emerging markets continue to boost the demand for oil because as economies become more developed, they consume more oil: The United States is the largest consumer of oil in the world, not because we have the largest population, but because we have the largest developed economy. India, one of the most notable emerging markets, is importing 8.5% more oil this year than a year ago. Mexico is building a refinery with a potential capacity of 340,000 barrels per day.

- Resilience of the U.S. Market – Despite an expected slowdown in the economy, the EIA projects a rise in U.S. petroleum consumption in 2023. U.S. demand remains critical as the world’s top oil consumer.

A few supply-side factors should be highlighted:

- U.S. Oil Rig Counts Peaking – The demand for additional oil rigs in the U.S. has peaked and begun to roll over. Following peak prices in 2022, oil rigs have since declined from a recent peak of 627 on December 2nd to just 593 active rigs as of March 24th. Fewer rigs lead to lower supply over time.

- OPEC’s Influence – OPEC remains invested in high oil prices and is determined to keep prices at attractive levels. We should expect them to continue tempering supply to seek higher prices.

- Russia’s Infrastructure Collapse – Since the onset of the Ukraine war, most of Russia’s financial resources have been routed to fighting Ukraine and away from economic development, including their energy infrastructure. This, combined with dried-up foreign investment and technological support for their energy sector, has led to deteriorating equipment and reduced capacity for supply. Over time it will become more and more difficult for Russia to keep up the pace of its energy output, lowering its influence on global crude supply.

Natural Gas – We remain convicted in the long-term viability, attractiveness, and profitability of the segment; however, near-term headwinds have made natural gas investment less attractive. Natural gas prices surged over 2022 as Russian supply left the market, but an extremely warm winter left the world less gas-strapped than expected entering Spring of 2023. High stocks and low demand should continue until the unpredictability of next Winter, which leaves Natural Gas a less attractive segment of the market. The next major catalyst for natural gas prices comes in 2025 when significantly more liquified natural gas (LNG) shipping capacity comes online at U.S. ports. Until then, the infrastructure pipeline is sparse and new gas demand is relatively weather-dependent. For this reason, we have reduced our natural gas exposure to only our highest conviction names. There will be a time in the future to reinvest more heavily in the natural gas segment, but that time will be closer to 2025 when we can enjoy the tailwinds of increased LNG exports.

Reemergence of Emerging Markets

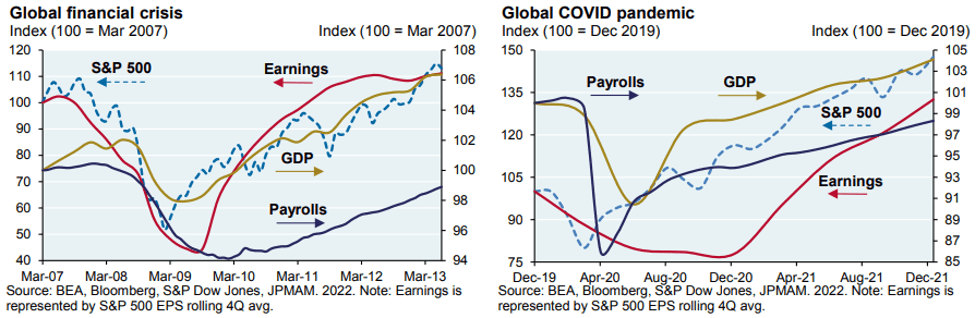

Following the supply chain chaos of the Covid era, countries including the United States are increasingly trying to reorganize their supply chains away from China and closer to home. Two huge beneficiaries of this supply chain movement will be Mexico and India.

Mexico benefits from a combination of 1. Proximity to the U.S. 2. Relatively cheap labor and 3. Status as a geopolitical ally of the United States. These factors drive attraction to the Mexican market. As U.S. yields soared, most currencies depreciated against the dollar. The peso on the other hand has strengthened almost 10% to the dollar over the past year, driven by export revenue and foreign investment in the country. Many Chinese companies have moved some production to Mexico, to retain the American consumer. At the same time, many American companies have moved production from China to other Asian countries and to Mexico.

Tariffs and moving away from China’s COVID lockdowns, coupled with rising international shipping costs and a desire to “nearshore” production to end-markets, have and continue to drive more than just Chinese firms to open factories in northern Mexico.

India serves the west as a new source of cheap, yet well-educated labor. India provides an attractive alternative to China’s supply chain with a government not so politically misaligned with the United States. Its enormous population growth will serve as a world growth engine moving forward, and the countries and industries surrounding India’s emergence will benefit.

Indian companies, banks, and households have low leverage, and their asset quality is improving, which positions the country well in this new global environment of tighter monetary policy and high interest rates.

To take advantage of emerging market activity, we are taking broad-based exposure to these economies along with targeted exposure to companies that benefit from the ongoing growth in these two countries.

Stomaching Volatility – Brighter Days are Ahead!

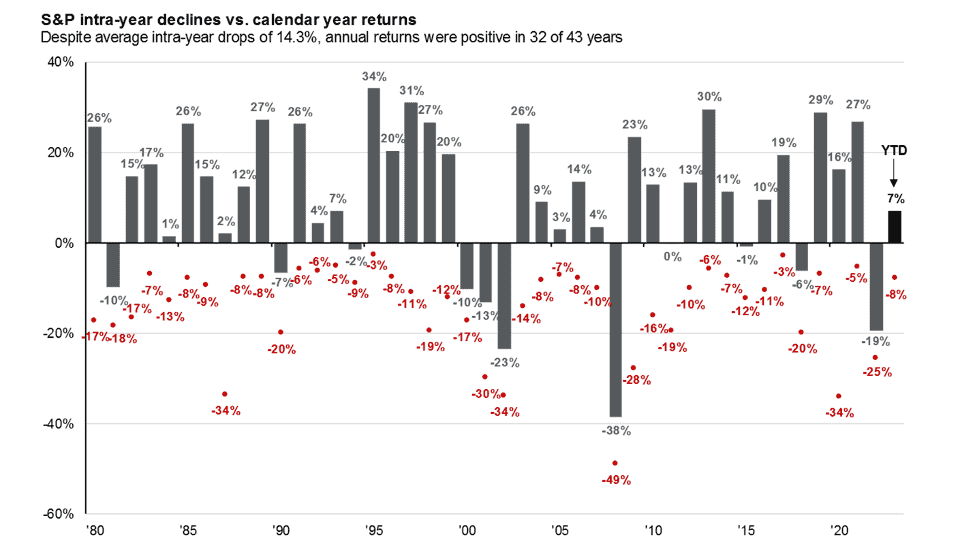

The volatility and perplexing investment environment have made 2022 and the start to 2023 unsettling for most investors. Uncertainty has been high and riding the rollercoaster of markets has been exhausting, but we believe we are nearing brighter financial days ahead. Interest rates are peaking, consumer sentiment is improving, the banking crisis is stabilizing, and earnings expectations are bottoming. These data points in and of themselves aren’t necessarily encouraging, but we believe they are marking a turning point in the investment narrative. The investing environment isn’t the best its been, but we believe we are looking at relatively better days ahead. While we believe the market will slowly improve from here, it is important to remain invested during periods of extreme market declines. Most investors are loss averse and are more hurt by losses than by gains but selling out of the market at the wrong time can have dramatic consequences for one’s portfolio. The chart below shows intra-year drops for the S&P 500 along with the end-of-year calendar period return.

Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Returns shown are calendar year returns from 1980 to 2022, over which time period the average annual return was 8.7%.

This data shows volatility is normal. Selling out at the bottom of a pullback can be devastating during bouts of volatility because some of the best market days typically follow the worst days. We believe staying invested is key to witnessing the fulfillment of an investment thesis and is critical to the investment process. Handling down market days is difficult, but you are likely to be rewarded by staying invested through the cycle.

In the meantime, as markets remain turbulent, we will continue to take advantage of the volatility. We plan to take advantage by continuing to invest in structured notes and Defined Parameter investments. These instruments have helped reduce the volatility in our portfolios while providing what we believe are attractive upside returns. We are being patient with our return to growth equity investment, sticking to companies in which we have the highest conviction, and staggering our entry points into the market. We plan to use down days as opportunities to pick up positions in our favorite securities and large up days to trim positions we believe have run their course.

Conclusion

The banking crisis is stabilizing, the Fed is nearing or has reached peak interest rates, corporate America is refocusing on profitability, and underlying economic data is staying resilient. There is far more to be optimistic about heading into the second quarter of 2023 than there was to start the year. Uncertainty is still high, and volatility will continue, but we plan to take advantage of it when we can. There is no guarantee how the rest of the year will pan out, but we will allocate strategically as the macro environment develops and will act tactically when there are opportunities.

Talking markets is our passion, so if you have any questions or would like to continue the conversation, please don’t hesitate to reach out to us.

Disclosures:

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.

INTERNATIONAL INVESTING

Investing internationally carries additional risks such as differences in financial reporting, currency exchange risk, as well as economic and political risk unique to the specific country. This may result in greater share price volatility. Shares, when sold, may be worth more or less than their original cost.

EMERGING MARKETS INVESTING

Investments in emerging markets may be more volatile and less liquid than investing in developed markets and may involve exposure to economic structures that are generally less diverse and mature and to political systems which have less stability than those of more developed countries.

REIT

A REIT is a security that sells like a stock on the major exchanges and invests in real estate directly, either through properties or mortgages. REITs receive special tax considerations and typically offer investors high yields, as well as a highly liquid method of investing in real estate. There are risks associated with these types of investments and include but are not limited to the following: Typically no secondary market exists for the security listed above. Potential difficulty discerning between routine interest payments and principal repayment. Redemption price of a REIT may be worth more or less than the original price paid. Value of the shares in the trust will fluctuate with the portfolio of underlying real estate. There is no guarantee you will receive any income. Involves risks such as refinancing in the real estate industry, interest rates, availability of mortgage funds, operating expenses, cost of insurance, lease terminations, potential economic and regulatory changes. This is neither an offer to sell nor a solicitation or an offer to buy the securities described herein. The offering is made only by the Prospectus.

Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value.