2nd Quarter Outlook, 2016

The stock market started off the year exceptionally weak, with all major market indexes down double digit percentages going into the low on February 11. We believe much of the weakness was due to selling by foreign sovereign wealth funds, where the related country’s fiscal budget is heavily affected by the price of crude oil. An  example of this is Saudi Arabia, which is reportedly running a monthly fiscal budget deficit of nearly $20 billion. As crude oil bottomed on February 11, pressure was lifted from the U.S. stock market. In fact, since that price low in crude oil, the stock market has rebounded with the indexes ending nearly flat for the quarter. We believe that so long as crude oil does not make another new price low this year, neither will the stock market make another new low. However, we do expect crude oil to weaken in the first few weeks of April due to the scheduled maintenance that refineries conduct this month. As refinery maintenance is completed, the oil refiners will resume the regular purchases of crude. Refinery re-starts, combined with a slow decrease in domestic production and a steady increase in demand, should move oil to the $50 range by year-end. However, without a geopolitical event, we do not expect oil to significantly breach the $60 level in the foreseeable future. Horizontal drilling has become very efficient and can be very profitable at $50/bbl. Drilling turn around time has also decreased, now taking only two months from the start of drilling to the selling of oil.

example of this is Saudi Arabia, which is reportedly running a monthly fiscal budget deficit of nearly $20 billion. As crude oil bottomed on February 11, pressure was lifted from the U.S. stock market. In fact, since that price low in crude oil, the stock market has rebounded with the indexes ending nearly flat for the quarter. We believe that so long as crude oil does not make another new price low this year, neither will the stock market make another new low. However, we do expect crude oil to weaken in the first few weeks of April due to the scheduled maintenance that refineries conduct this month. As refinery maintenance is completed, the oil refiners will resume the regular purchases of crude. Refinery re-starts, combined with a slow decrease in domestic production and a steady increase in demand, should move oil to the $50 range by year-end. However, without a geopolitical event, we do not expect oil to significantly breach the $60 level in the foreseeable future. Horizontal drilling has become very efficient and can be very profitable at $50/bbl. Drilling turn around time has also decreased, now taking only two months from the start of drilling to the selling of oil.

The prior twelve month period has contained two market declines in excess of twelve percent, and two subsequent rebounds. The volatility is producing fatigue in some investors. It is a great environment for the aggressive marketing of equity-indexed annuities, whose projected returns can look good on paper but are not likely to perform nearly as well as touted by salespeople. Like bonds and certificates of deposit, we remind clients that annuities will only perform well when interest rates are significantly higher.

Fortunately, this environment of slow economic growth, low interest rates and market volatility produces opportunities for nimble investors. We believe that capital flows are more significant than individual company fundamentals in driving short-term price movements. ETF investing has become extremely popular with many individuals and institutions. When the ETF capital flows out, often the good companies are taken down with the bad in the associated industry group. This outflow of capital often provides us the opportunity to identify companies with attractive fundamentals that we can buy on weakness. With that backdrop, we have recently added several positions to the portfolios which yield 4% to 10%; we also believe many of these will produce capital gains.

Domestic employment and the macro-economy

Since November 2009 the United States has consistently added jobs, and the unemployment rate has steadily fallen. But the ‘Pouting Pundits of Pessimism’ keep arguing that a falling unemployment rate is only due to weak growth of the labor force. So, when the recent unemployment data for March showed growth in the labor force and a rising unemployment rate (from 4.9% to 5.0%), guess what the pundits focused on? The rising unemployment rate, of course.

We are not diehard bulls and will take a cautious or even bearish position when the facts and data suggest we should – as was the case in 2008. At this point however, we do not see significant data pointing to a recession in the United States. Recessions are driven primarily by job losses. The household survey and the payroll reports show positive job growth of 234,000 per month for the past twelve month period. This is slow economic growth, consistent with what we have deemed “The Plow-Horse Economy”.

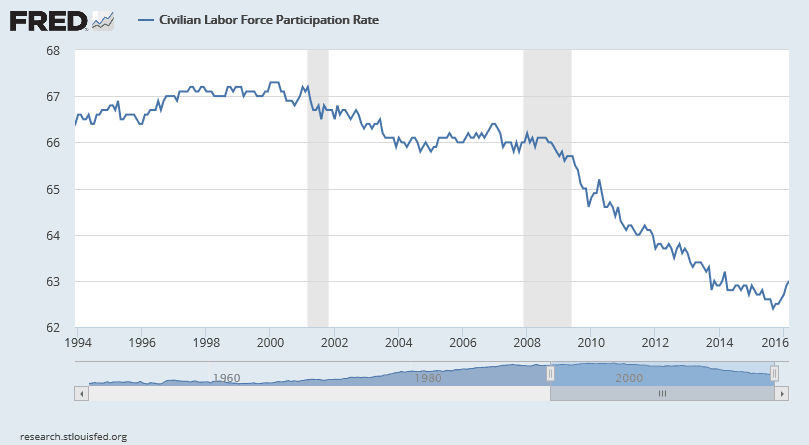

A welcome recent change has been a pick-up in the growth of the labor force. The total number of people in the American labor force is up 2.2 million in the past year, the largest increase since 2007-08. The labor force is growing faster than the overall population, with the labor force participation rate perking up to 63%. It bottomed in 62.4% in September 2015, and many economists expect expansion to continue. While 63% is still low by historical standards, it nonetheless shows that economic growth is finally overcoming the loss of retiring baby boomers and overly generous government handouts to those not working.

One reason for the growth in the labor force is faster wage growth. Average hourly earnings (workers’ cash earnings, excluding tips and irregular bonuses/commissions) are up 2.3% in the past year. In fact, hourly earnings are showing recent acceleration – up 2.7% annually in the first three months of 2016. Those earnings go farther too, with the decline in gasoline prices holding down inflation.

Importantly, this acceleration in wages is occurring while the Federal welfare state’s expansion rate is slowing. Obamacare and more generous Social Security Disability Income eligibility rules have produced growth in Federal dependence over the last seven years, and have driven down the labor force participation rate. If wages continue to grow as we expect, more people will be drawn into the labor force. We are hoping for a shift in policy due to a new Administration – one that produces incentives to work. In such a situation, we believe jobs and the labor force participation would grow even faster. Time will tell which way the political winds will blow in November.

International monetary policy, macro-economics, capital flows and the U.S. Dollar

Europe, Japan and much of the rest of the world is continuing their effort to spur economic growth through central bank intervention – Quantitative Easing (money printing) and in some cases, negative interest rates. These are economic policies of near-desperation, in our view. The Europeans and the Japanese are fighting off recession with monetary policy rather than true structural reform. Archaic and protective labor laws stifle competition and preserve their cradle-to-grave nanny state. We remain skeptical that their monetary policy focus will produce significant economic growth, but then again, Europe has been cruising along with slow economic growth for decades.

A significant concern not lost on investors is the soundness of the large European banks. Deutsche Bank, Credit Suisse Group and Barclays PLC have all seen their common share prices decline greater than 33% in 2016. We believe some of this selling was done by foreign sovereign wealth funds (the Saudis and the Gulf States – again). The positive for the United States is that we believe this capital has flowed to our large multi-national U.S. corporations and our Treasury bond market.

Somewhat paradoxically, the U.S. Dollar has been weakening recently versus a basket of currencies containing the Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona and Swiss Franc. As you can see from the graph on the right, the Dollar is down more than 7% since its high in March of 2015. Much has been written about how the Dollar strength has hurt the earnings of U.S. multi-national corporations who derive more than 40% of their revenue from overseas sales. We haven’t heard much discussion yet about recent Dollar weakness, and how this will make earnings comparisons look better as we go through the year if the Dollar remains in this range. If the stock market is to move meaningfully higher, we believe a cooling Dollar could be a catalyst for it to do so.

Alternative Investments – new FINRA pricing rule

For clients who have positions in fixed income Alternatives – primarily SEC registered, non-publicly traded REITs – you should be aware that the Financial Industry Regulatory Authority has recently implemented a new pricing rule. Prior to the rule change, the public offering price (POP, price paid by investors that paid the commission) was listed on your statements. By April 11th, all Alternatives will reflect their (1) appraised net asset value, or (2) for those funds that are raising capital and/or have not yet been appraised, they will reflect the POP minus the commission and start-up costs. We do not disagree with the intent of the rule, but it needs to be understood that the individual property appraisal does not include an aggregation premium (value of aggregating many properties) and often will undervalue the portfolio as recent purchases have not begun to provide significant income or have ongoing improvements which are not valued. The bottom line for us – we will see a larger capital gain (or smaller capital loss) at liquidation. Previously, we saw the benefit of not paying the commission, up-front. Our clients will still not pay the commission, so the capital gain will be calculated on the actual cost ($9.30 or $23.25) rather than the POP ($10 or $25).

In the meantime, we continue to view our challenge in the current environment as finding exceptional opportunities that produce solid income and growth. We do not view the stock market as exceptionally cheap nor expensive; in this kind of environment sound selection is key. We are constructing portfolios that seek to produce attractive dividend yields between 4% – 10% and dampen market volatility.

If you have any questions about your portfolio, our outlook, or the state of the investing world please do not hesitate to call. Thank you for your continuing support.

Sincerely,

The Beck Capital Team

April 7, 2016

https://www.facebook.com/BeckCapitalManagement/

Please feel free to forward this to friends who you believe might be interested.

All rights reserved by Beck Capital Management LLC.

If you would like to receive a copy of our Privacy Policy or Form ADV, Part II brochure, please let us know and we will be happy to provide it to you.

Disclosure: Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Frank Beck & Beck Capital Management explicitly disclaims any responsibility for product suitability or suitability determinations related to individual investors. The investment products discussed herein are considered complex investment products. Such products contain unique risks, terms, conditions and fees specific to each offering. Depending upon the particular product, risks include, but are not limited to, issuer credit risk, liquidity risk, market risk, the performance of an underlying derivative financial instrument, formula or strategy. Return of principal is not guaranteed above FDIC insurance limits and is subject to the creditworthiness of the issuer. You should not purchase an investment product or make an investment recommendation to a customer until you have read the specific offering documentation and understand the specific investment terms and risks of such investment.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.