April 2017 Market View

The U.S. Economy Advances As Washington Toils At Reform

Since the November election, the media, investors and the public have been focused on the reform agenda in Washington. While the failure of Congress to pass healthcare reform has hampered progress on tax reform, it has not meaningfully slowed the U.S. economy. In fact, the domestic economy has continued to grow at roughly the same pace as late last year. However, we believe the economy has a real opportunity to accelerate once Congress makes meaningful progress – and we think eventually they will.

In the meantime, we continue to implement our growth & income strategy – looking for companies with attractive valuations, earnings growth and solid dividends. But more on that later.

The Fed’s Path To “Normalizing” Interest Rates – Steady As She Goes

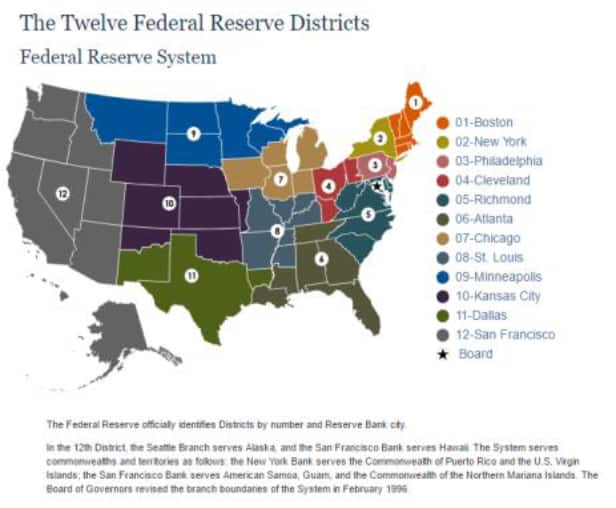

The Federal Reserve has gone out of its way to provide transparency into their thinking about how they will “normalize” interest rates. After two raises of the Fed Funds rate since December 2015, (now at 0.87%), the Fed is now also contemplating how to sell off portions of the U.S. Treasury Bonds and mortgage backed securities that they hold on their balance sheet. Recall that the Fed’s Quantitative Easing program involved their unprecedented buying of huge amounts of government paper, expanding their balance sheet from approximately $440 billion to over $4.3 trillion. Now with U.S. GDP growth in its eighth consecutive year, unemployment under 5%, wage growth advancing, small business confidence at a 12 year high and sound balance sheets of the nation’s money center banks, the Fed sees no need to remain on a crisis footing.

Talk of Interest rate “normalization” has caused, and will continue to cause, angst among some institutional and individual investors. We think this concern will be amplified by the financial media going forward as they scrutinize and parse every word by Fed Chair Janet Yellen and her colleagues. It is understandable that investors would feel angst in this tightening cycle, especially since bonds have been in a secular bull market for over 35 years. In fact, many professionals on Wall Street have never seen a tightening cycle during their careers, as the last meaningful one took place in the late 1970’s / early 1980’s when Paul Volker was Fed Chairman. Of course, the economic conditions today are quite different than the days of the 1980 “misery index” (high inflation, high unemployment & high interest rates), but nonetheless, a good percentage of Wall Street and individuals (those under 60) have never seen the Fed persistently raise interest rates.

Talk of Interest rate “normalization” has caused, and will continue to cause, angst among some institutional and individual investors. We think this concern will be amplified by the financial media going forward as they scrutinize and parse every word by Fed Chair Janet Yellen and her colleagues. It is understandable that investors would feel angst in this tightening cycle, especially since bonds have been in a secular bull market for over 35 years. In fact, many professionals on Wall Street have never seen a tightening cycle during their careers, as the last meaningful one took place in the late 1970’s / early 1980’s when Paul Volker was Fed Chairman. Of course, the economic conditions today are quite different than the days of the 1980 “misery index” (high inflation, high unemployment & high interest rates), but nonetheless, a good percentage of Wall Street and individuals (those under 60) have never seen the Fed persistently raise interest rates.

We anticipate that the Fed will be VERY measured in raising rates and rolling assets off their balance sheet. Inflation is not accelerating meaningfully, and we see no factors on the horizon causing it to do so. Therefore, the Fed has some leeway. After their March meeting the Fed indicated that they plan on raising rates by just one-half percentage point this year. Their asset sales will be impacted by the calendar however. They will be forced to take action – either to sell or rollover their positions – within the next 24 months as their bonds mature. Institutional investors understand all this and are working to include possible Fed sales into their tightening calculus. Steady and very measured as she goes, is what we foresee in interest rate increases and Fed bond liquidation over the intermediate term.

“Bonzi Scheme”

We have seen a recurring trend this past year: bond salespeople focusing on marketing bond coupon rates rather than yield-to-maturity. This is a way for them to hide poor yields-to-maturity (what an investor actually receives over time for holding the bond). A bond may have a 5% coupon, but because that bond is selling at a premium, the actual yield to the investor is much lower. For example, if a bond has a 5% coupon, is five years from maturity, and is selling at 15% over par, the yield to the investor is approximately 1.7%. Thus, the investor is receiving $30 each year of his own money (hence “Bonzi Scheme”) since the bond will mature at 100. Therefore, of the $50, only $20 is actual gain. $20 on a $1,150 investment is 1.74%. This math is also correct for bonds already owned by an investor.

Understanding the relationship between coupon yield and yield-to-maturity is critically important in times like today, when interest rates are very likely to rise. It may behoove an investor to sell at a current premium, rather than watch that premium evaporate over the remaining years on the bond.

Understanding the relationship between coupon yield and yield-to-maturity is critically important in times like today, when interest rates are very likely to rise. It may behoove an investor to sell at a current premium, rather than watch that premium evaporate over the remaining years on the bond.

Bond mutual funds and Bond Exchange Traded Funds (ETFs) can be especially vulnerable in a rate hiking cycle. Bonds within a bond fund have the same diminishing value as bonds held individually, yet a bond fund’s price is dependent on what investors are willing to bid for fund shares at the time. Therefore, losses in bond funds are NOT capped at par value, as they are with individual bonds. In a fast moving market when interest rates are raised, investors may see bond fund prices decline rapidly as investors back away from bidding on the funds. Bond fund holders beware.

U.S. Stock Market Trend & Valuation

Donald Trump’s surprising election and the ensuing rally in the U.S. stock market since November has left investors asking two questions: How much of the rally has already priced-in healthcare, tax and regulatory reform? If the reforms don’t materialize, how much market downside risk is there?

We believe a small fraction of the 10% rally in the S&P 500 since the election is due to proposed tax and regulatory reform. Here’s why: before the election the forward price/earnings multiple of the S&P 500 was near 18. Today it is near 19. Consequently, much of the market’s advance is due to improving earnings and Wall Street analysts raising their earnings estimates.

Of course, the talking heads in the financial media add little insight to help investors understand the market’s trend or valuation. They chatter about “Dow 20,000” and the market making new highs as if they were negative things, when they should be discussing the possible factors that would cause the Dow to be 30,000 in several years or 40,000 in ten years – scenarios that we see very plausible if meaningful reforms are enacted.

No doubt that you will continue to hear about how government action or inaction will determine the market’s trend. Yes, reforming the healthcare system and cutting corporate tax rates and unnecessary regulations will add fuel to the stock market. However, we believe all of these are not necessary for the market to sustain a long-term advance – the economy and earnings continue to grow.

We have said during our investor meetings and in prior communications that we view the market’s valuation as neither “cheap” nor “expensive”. It trades in the mid-range of historical valuation. Since 1990 the S&P 500 has traded between 12x and 30x forward earnings estimates. As noted above, it is now about 19x forward estimates. At the beginning of the year Wall Street’s consensus earnings estimates for the S&P 500 was $132. At 18x $132 one arrives at a 2017 year-end price target of 2,376 or a +6.1% return for the year (ex-dividends). Per our calculations, if Congress and the Administration can enact 1) healthcare reform, 2) corporate tax reform and 3) corporate capital repatriation, we could see the S&P 500 earning approximately $145. At 18x $145 of earnings, this produces a year-end target price of 2,614 for the S&P 500. This would be a +16.7% return (ex-dividends). We have been criticized by some in New York for providing a target return of between +6.1% to +16.7% for the year – for our being “wide and imprecise” in our target. Our response is this: “You tell us how many meaningful reforms will be enacted, and what they will be, then we will determine a narrower and more precise target return!” The fact is, no one knows ultimately how much of the reform agenda will be passed, and when it will be passed. We do know that $85 billion worth of regulatory reform has already been signed by President Trump. We also believe some form of healthcare, corporate tax reform and capital repatriation will come. Time will tell how much. Therefore, we watch news events and the market’s reaction to the news extremely carefully.

We have said during our investor meetings and in prior communications that we view the market’s valuation as neither “cheap” nor “expensive”. It trades in the mid-range of historical valuation. Since 1990 the S&P 500 has traded between 12x and 30x forward earnings estimates. As noted above, it is now about 19x forward estimates. At the beginning of the year Wall Street’s consensus earnings estimates for the S&P 500 was $132. At 18x $132 one arrives at a 2017 year-end price target of 2,376 or a +6.1% return for the year (ex-dividends). Per our calculations, if Congress and the Administration can enact 1) healthcare reform, 2) corporate tax reform and 3) corporate capital repatriation, we could see the S&P 500 earning approximately $145. At 18x $145 of earnings, this produces a year-end target price of 2,614 for the S&P 500. This would be a +16.7% return (ex-dividends). We have been criticized by some in New York for providing a target return of between +6.1% to +16.7% for the year – for our being “wide and imprecise” in our target. Our response is this: “You tell us how many meaningful reforms will be enacted, and what they will be, then we will determine a narrower and more precise target return!” The fact is, no one knows ultimately how much of the reform agenda will be passed, and when it will be passed. We do know that $85 billion worth of regulatory reform has already been signed by President Trump. We also believe some form of healthcare, corporate tax reform and capital repatriation will come. Time will tell how much. Therefore, we watch news events and the market’s reaction to the news extremely carefully.

As we wade through the ups and downs of market waves due to news events out of Washington, we continue to look for companies to invest in that are reasonably priced, have attractive growth characteristics and pay attractive dividends. Our dividend-paying positions range from 5% to 11% and help provide “ballast” during market up and down waves. In fact, the average of all 12 of our core dividend paying positions is greater than 4x the S&P 500 dividend yield. We use sophisticated institutional-grade databases and tools to help us find these opportunities. The challenge is to manage through the waves and realize long-term capital gains supplanted by attractive dividends while we wait for value to be recognized by the market.

Technological Advances, Productivity, Career Change & Retirement

“Change has never happened this fast before, and it will never be this slow again.” – Graeme Wood

Step back from the day-to-day headlines and consider the age we live in. While we face significant geo-political challenges, we also live in a time of unprecedented rapid technological change and advancements. Whether winning the fight to prolong life from many cancers (including breast, colon, prostate and leukemia), producing domestic energy with methods to free our dependence on Middle-eastern oil, using smartphones that contain more processing power than the Apollo 11 CPU… having 3-D printing, Cloud computing, genome mapping and robotics… human creativity and entrepreneurship is alive and thriving. These advancements are improving our life and driving productivity. In fact, change is happening so rapidly that experts say college students graduating in 2017 will need to undergo constant life-long education, as they will likely face at least 3 major shifts in their careers over the next 50 years. This rapid change also has important implications for financial planning, as we live longer, retire later and require more resources saved for retirement.

Rising life expectancy and constant change are two reasons why we relentlessly discuss the importance of retirement planning and active investment management. If a loved one you know (of any age) hasn’t given retirement planning much thought, we encourage you to discuss it with them. Investing passively in index funds (“buy and don’t look investing”) won’t get the job done, and can be riskier than many people think. We’re always happy to talk with people in this situation – no obligation. Feel free to have them call us.

Rising life expectancy and constant change are two reasons why we relentlessly discuss the importance of retirement planning and active investment management. If a loved one you know (of any age) hasn’t given retirement planning much thought, we encourage you to discuss it with them. Investing passively in index funds (“buy and don’t look investing”) won’t get the job done, and can be riskier than many people think. We’re always happy to talk with people in this situation – no obligation. Feel free to have them call us.

In the meantime, if you have any questions or concerns please feel free to call. We will be holding our next client / guest reception & update in late September and hope you will be able to attend – look for a notice in early September.

With best wishes from all of us at Beck Capital

April 24, 2017

https://www.facebook.com/BeckCapitalManagement/

Please feel free to forward this to friends who you believe might be interested. To make sure you don’t miss our urgent updates, add Bryan@BeckCapitalManagement.com to your address book. If you have received this from a friend and would like to receive the next six issues at no cost or obligation, please send an email to Bryan@BeckCapitalManagement.com

All rights reserved by Beck Capital Management LLC.

If you would like to receive a copy of our Privacy Policy or Form ADV, Part II brochure, please let us know and we will be happy to provide it to you.

Investment advisory services offered through Beck Capital Management LLC, a registered investment adviser.This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Beck Capital Management explicitly disclaims any fiduciary responsibility or any responsibility for product suitability or suitability determinations related to individual investors, as may relate to the information contained herein.

Disclosure: Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Frank Beck & Beck Capital Management explicitly disclaims any responsibility for product suitability or suitability determinations related to individual investors. The investment products discussed herein are considered complex investment products. Such products contain unique risks, terms, conditions and fees specific to each offering. Depending upon the particular product, risks include, but are not limited to, issuer credit risk, liquidity risk, market risk, the performance of an underlying derivative financial instrument, formula or strategy. Return of principal is not guaranteed above FDIC insurance limits and is subject to the creditworthiness of the issuer. You should not purchase an investment product or make an investment recommendation to a customer until you have read the specific offering documentation and understand the specific investment terms and risks of such investment.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.