Federal Reserve

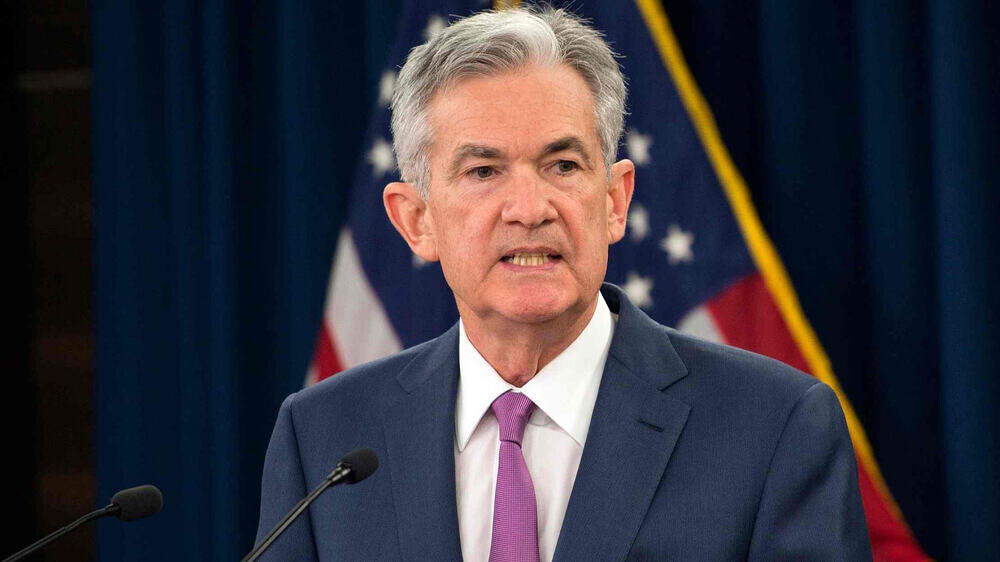

2018 began with a roar and ended with a Federal Reserve Chairman’s thud. With a strong economy, the stock market was clicking along nicely until Fed Chairman Jerome Powell, during an October 3rd interview, said the Fed was a long way from “neutral” interest rates. In fact, he alluded to the possibility that the Fed might raise rates until they are “restrictive” to economic growth. To make matters worse, he went on to say that the Fed’s “Quantitative Tightening” of $50 billion per month in asset sales were on “autopilot” – not subject to review & change. Powell’s comments sent the markets into a nearly three-month decline. Each day we expected Powell to walk back his remarks. Unfortunately, he did not. As a result, Powell may be remembered as possibly the worst Fed Chairman in history.

On Christmas Eve, New York Fed President John Williams held an interview with the financial media. In the interview, Williams said that the Fed was actually looking at what is going on in the rest of the world! His comments were important because Powell’s remarks had sent long-term interest rates and the dollar higher. Williams sought to soothe worries. A rising dollar hurts U.S. exporters and emerging markets because their debt is mostly denominated in U.S. dollars. Further, a stronger dollar increases the cost for emerging market countries to service their debt in their own currency. With this condition, the concern was that emerging market economies could weaken further, ultimately spread to developed markets, and perhaps even to the U.S.

We felt the impact of the weakness in the general market, which dropped about 20% from the time Powell made his remarks, into the low on December 24. Unfortunately, the spike in interest rates even caused our most conservative accounts to suffer in a disproportionate way. Conservative accounts tend to hold more and higher-yielding dividend paying securities in order to generate income. The 4th Quarter spike in interest rates caused knee-jerk selling of these securities. At the time, the thought on the Street was that if you were earning 7% in a high dividend paying stock, and the 10-year Treasury Note was paying 2%, you were enjoying a 5% difference. However, when the 10-year Note jumped up to 3.25%, the difference was only 3.75%, thus the dividend paying securities were worth less than before.

When the 10-year Treasury Note dropped back to approximately 2.65%, dividend paying stocks did not immediately recover because the general market was experiencing year-end tax loss selling. There were scant buyers at the time. The market is becoming more rational now, and the condition is being remedied as we write to you. We have increased our holdings in some of these securities at lower prices. As a result of the lower prices, many “dividend payers” yield in the 7% to 12% range. Further, we are selecting companies whose earnings support their dividend payouts, and we are purchasing many of these companies below book value. At these yields and valuations, we believe a decent floor has been established under their stock prices. With a strengthening market, we are expecting capital gains and dividends from these positions.

Health of the Markets

At the time Fed Chairman Powell made his remarks on October 3, the stock market was coping well with European and Chinese tariffs, the Mid-Term election campaign, Brexit, NAFTA, and other concerns. Now the elections are behind us and progress is being made in other areas. We expect elevated political rancor and may even hear calls for Trump’s impeachment out of some in Congress, but we don’t anticipate much of it to make an important economic impact. We view the rancor as just political “noise” that we’ll have in the background. In fact, markets often do best during periods of divided government because little of significance can get done in Washington, D.C. Stalemate creates a stable regulatory climate, and thus makes it easier for business to navigate and plan. Additionally, NAFTA has now been renegotiated and will hopefully be ratified by Congress, a step that we believe would be positive for the U.S. Trade negotiations with Europe are progressing, and China has reduced tariffs on a large number of foodstuffs and other products. Negotiations over Chinese trade barriers may go on for some time, but it appears U.S. and Chinese negotiators are making further progress narrowing their differences. The Federal Reserve has now indicated that one or two interest rate hikes may be needed in 2019, rather than the four previously contemplated. Importantly, Fed Chairman Powell has said the Fed is willing to be flexible in setting future monetary policy. Imagine that! Last, the Fed has also indicated that their asset sales (Quantitative Tightening) are also subject to flexibility as economic numbers are reported. Interest rates have calmed, and the U.S. dollar appears to have topped, or at least, is not likely to strengthen at its previous rate

The bottom line: The headwinds have shifted. We now have a soft breeze developing at our backs. The U.S. economy remains strong, stock valuations are more attractive, and we are finding investment candidate companies which pay dividends and have solid growth prospects.

5G – 5th Generation Wireless Systems

5G will be a huge improvement over today’s 4G cellular networks. Many telecom experts herald the arrival of 5G as the advent of the “Fourth Industrial Revolution”. 5G networks will offer consumers incredible broadband speed at home (up to 20Gb/s or 20 times faster than currently available). They will also enable companies to make advancements in (1) smarter, better connected cars, (2) more “personalized” medical treatments & devices, and (3) improved retail experiences. Fast 5G speeds will also allow for improvements in Augmented Reality (AR), Virtual Reality (VR), Artificial Intelligence (AI), Robotics, Cloud Applications, Immersive Education, and more. When we say 20 times faster transmission speed, it may actually be a disservice in describing how much better 5G truly is. When you add the various benefits, you might say it is 100 times better. Reduced latency, much higher frequencies – combined with speed – will make autonomous vehicles and other exciting new developments a reality. We believe this all adds up to an enormous investment opportunity over the next several years.

Predicting the S&P 500 – Quantitative Tightening – Index Investing

When one hears pundits make predictions about the future performance of the S&P 500, remember: the index is composed of only 500 companies. Some are solid growers, while others are slow-growing utilities and others aren’t growing at all. In fact, Street analysts estimate that over 10% of the S&P 500 will have ZERO earnings growth in the coming year! At a time when the Federal Reserve is engaged in Quantitative Tightening rather than Quantitative Easing, we believe it is likely the indexes will significantly underperform the best positioned and best-run companies. A rising tide driven by QE over the last ten years lifted all boats and made “Indexing” a viable investment strategy – assuming one could maintain the investment during tough times. However, during Quantitative Tightening that the Fed is engaged in now, we believe Index investing will become less attractive. After ten years of QE, it may be hard for some investors to remember how fundamental stock picking and active portfolio management can pay off.

We believe they are about to be reminded.

Wishing you a happy & healthy 2019

The Beck Capital Management Team

January 11, 2019

www.beckcapitalmanagement.com https://www.facebook.com/BeckCapitalManagement.com

Investment advisory services offered through Beck Capital Management LLC, a registered investment adviser. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results. Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Beck Capital Management explicitly disclaims any fiduciary responsibility or any responsibility for product suitability or suitability determinations related to individual investors, as may relate to the information contained herein. The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock’s weight in the index proportionate to its market value. There is no guarantee that companies that can issue dividends will declare, continue to pay, or increase dividends.