THE ECONOMY:

QE2 is all over the news these days and I am not referring to the transatlantic ocean liner. Quantitative Easing, part II, Ben Bernanke style, includes another $600 Billion of money-printing with another $200B-$300B of rollover (notes due and being refinanced). The Fed’s idea was to keep interest rates near zero by purchasing Treasuries in mass quantities. The Fed also believes that this additional money-printing will increase asset prices, making Americans richer so that they may resume “consumerism” and possibly even create some private-sector jobs.

QE2 is all over the news these days and I am not referring to the transatlantic ocean liner. Quantitative Easing, part II, Ben Bernanke style, includes another $600 Billion of money-printing with another $200B-$300B of rollover (notes due and being refinanced). The Fed’s idea was to keep interest rates near zero by purchasing Treasuries in mass quantities. The Fed also believes that this additional money-printing will increase asset prices, making Americans richer so that they may resume “consumerism” and possibly even create some private-sector jobs.

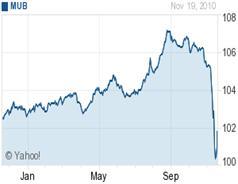

Interestingly though, the Fed told us in advance, what they would be buying. Upon the announcement of the  imminent purchases, big banks used near 0% money provided by the Fed, to buy the same Treasuries the Fed would soon begin to purchase. Interest rates dropped, but since the Fed began its purchases, the Banks began to sell. Interest rates have spiked higher with each Fed purchase rather than drop, all due to the Banks cashing in on their ability to front-run the Fed. Even asset prices have not gone the Fed’s way, though I believe Mr. Bernanke will ultimately win on this front – at least in the short-term. Thus far, equities have about broken even, while bonds, and especially bond funds, have taken a beating (evidenced by the muni bond ETF chart here).

imminent purchases, big banks used near 0% money provided by the Fed, to buy the same Treasuries the Fed would soon begin to purchase. Interest rates dropped, but since the Fed began its purchases, the Banks began to sell. Interest rates have spiked higher with each Fed purchase rather than drop, all due to the Banks cashing in on their ability to front-run the Fed. Even asset prices have not gone the Fed’s way, though I believe Mr. Bernanke will ultimately win on this front – at least in the short-term. Thus far, equities have about broken even, while bonds, and especially bond funds, have taken a beating (evidenced by the muni bond ETF chart here).

Ironically, the Fed might better be able to keep rates low and spur asset prices by ending QE2, or at least purchasing some other assets. So far, QE2 looks more like a transfer of taxpayer dollars to the Big Banks than it does any kind of real stimulus.

I’ve said for months now that a bond fund meltdown is on the way, though I expect the real pain to be inflicted when the Fed no longer has Congressional support for debasing the dollar. It is likely that there will not be a QE3, so come June when QE2 is spent, that will likely be the end. At that time, or as recent results have indicated that it could happen sooner, rates will rise. Once you lose a big buyer of bonds, interest rates rise as the bond prices fall. That spells disaster for bond funds and also those 401(k) darlings called “Target Date” funds which carry a large percentage of bonds.

Don’t confuse a bond fund for a well-structured ladder of bonds. Individual bonds have maturities and a ladder of bonds will have bonds maturing each year so if interest rates rise, your bonds still mature at full value (par / $1,000 per bond). You can spend or reinvest interest and as bonds mature, you can purchase new bonds at the higher interest rates. Say you have a seven-year ladder with approximately 1/7th of your bonds maturing each year for the next seven years. A year from now, 1/7th of your bonds mature and your ladder has remaining bonds which will mature each of the next six years. The interest from all the bonds may be used for income while you use the funds from maturing bonds to purchase additional bonds that will mature in seven years, thus keeping your seven-year ladder in tack.

Bond funds have no maturity. You cannot simply wait for your bonds to mature to get full value. If interest rates rise, the bonds will drop in value and it is reflected in reduced share prices. Some of the fund’s investors will sell, causing the bond fund manager to liquidate some bonds prior to maturity, in order to raise cash for investor redemptions. As rates rise further, the number of redemption requests increases and the fund’s manager must sell even more bonds at a loss. Since this occurs at all (or near all) funds at the same time, it becomes a buyer’s market. That is the time where we can step forward and build our bond ladders at bargain prices.

If you have any bond funds in your retirement plans at work or you know someone who owns bond funds, please share this with them. Don’t let history fool you. The last 30 years have been a bond fund’s dream world where interest rates fell from around 20% in 1980 to near 0% in 2010. It makes many an investor believe that bond funds are always safe because that is all they have known. Well, that was then and this is now. We can profit from owning bonds, but the only near-certain way going forward, is by buying bonds from distressed bond funds, at bargain prices.

NOTES:

RMD’s must be taken by December 31st. If you have turned 70 ½ this year or previously, you must take your Required Minimum Distribution from your IRA’s and other Qualified Plans.

Roth Conversions taken this year qualify for deferred taxation, one half of the taxable amount added to 2011 income and the second half added to 2012 income. It is a great opportunity for many of you.

GOLD – The Saga Continues:

I read an interesting quote about gold, by Warren Buffet recently. He said “It gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

Mr. Buffet missed the tech boom because he “does not understand it”. I think he is missing the point of gold too, although somewhat humorously, since the same Martians might find it equally puzzling that the Fed can take a $100 tree that has been cut down and turned into paper that we color with green ink and then pass it off as 600 billion dollars.

What Mr. Buffet and others are missing is that gold, silver and other hard assets are anti-currency investments. Gold has been the true currency for thousands of years and it has only been the last 39 years that we have experimented with fiat currencies. Unlike gold, governments have found it very easy to print more money, making it worth less in the terms of gold or other hard assets.

Of course, I also favor silver, copper, coal, trees, grain and water, along with a host of other hard assets that are used in industrial activity or for food. The pipelines and the rare earth metals are two more examples and have been all the rage in recent months – I am glad to say we were well ahead of the curve on them. In fact, the pipelines have made consistent money for us for many years – they continue to offer attractive dividends, growth, and a hedge against a devaluing dollar.

BOTTOMLINE:

For now, we will continue our theme of investing in companies with hard assets and companies selling goods and services to the growing middle classes of the emerging economies. The anti-currency trade is alive and well. If Washington gets its house in order, we will adapt, but many of these sectors will benefit in that environment as well.

I’ll continue to look forward to buying bonds at deep discounts. In the meantime, I hope everyone enjoys Thanksgiving.

Frank

512.345.6789

———————————————————————————————————————–

Information included in this electronic newsletter is not to be taken as investment advice. The information is general in nature and may not be appropriate for your individual situation.

The comments, graphs, forecasts, and indices published in Stock Market View are based upon data whose accuracy is deemed reliable but not guaranteed. Performance returns cited are derived from our best estimates but must be considered hypothetical inasmuch as we have investors who enter various investments at different times. If you have a friend, co-worker or family member who you feel could benefit from Stock Market View, please feel free to forward this edition.

To make sure you don’t miss our urgent updates, add Frank@FrankBeck.com to your address book.

If you have received this from a friend and would like to receive the next six issues at no cost or obligation, please send an email to FreeStockMarketView@FrankBeck.com (you may click on the link to send the message).

Please feel free to share this letter with friends, in its entirety only.

Copyright Warning and Notice: It is a violation of federal copyright law to reproduce all or part of this publication or its contents by any means. The Copyright Act imposes liability of up to $150,000 per issue for such infringement.

Disclosure: Nothing contained herein is to be considered a solicitation, research material, an investment recommendation or advice of any kind. The information contained herein may contain information that is subject to change without notice. Any investments or strategies referenced herein do not take into account the investment objectives, financial situation or particular needs of any specific person. Product suitability must be independently determined for each individual investor. Frank Beck & Beck Capital Management explicitly disclaims any responsibility for product suitability or suitability determinations related to individual investors. The investment products discussed herein are considered complex investment products. Such products contain unique risks, terms, conditions and fees specific to each offering. Depending upon the particular product, risks include, but are not limited to, issuer credit risk, liquidity risk, market risk, the performance of an underlying derivative financial instrument, formula or strategy. Return of principal is not guaranteed above FDIC insurance limits and is subject to the creditworthiness of the issuer. You should not purchase an investment product or make an investment recommendation to a customer until you have read the specific offering documentation and understand the specific investment terms and risks of such investment.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.